新入荷再入荷

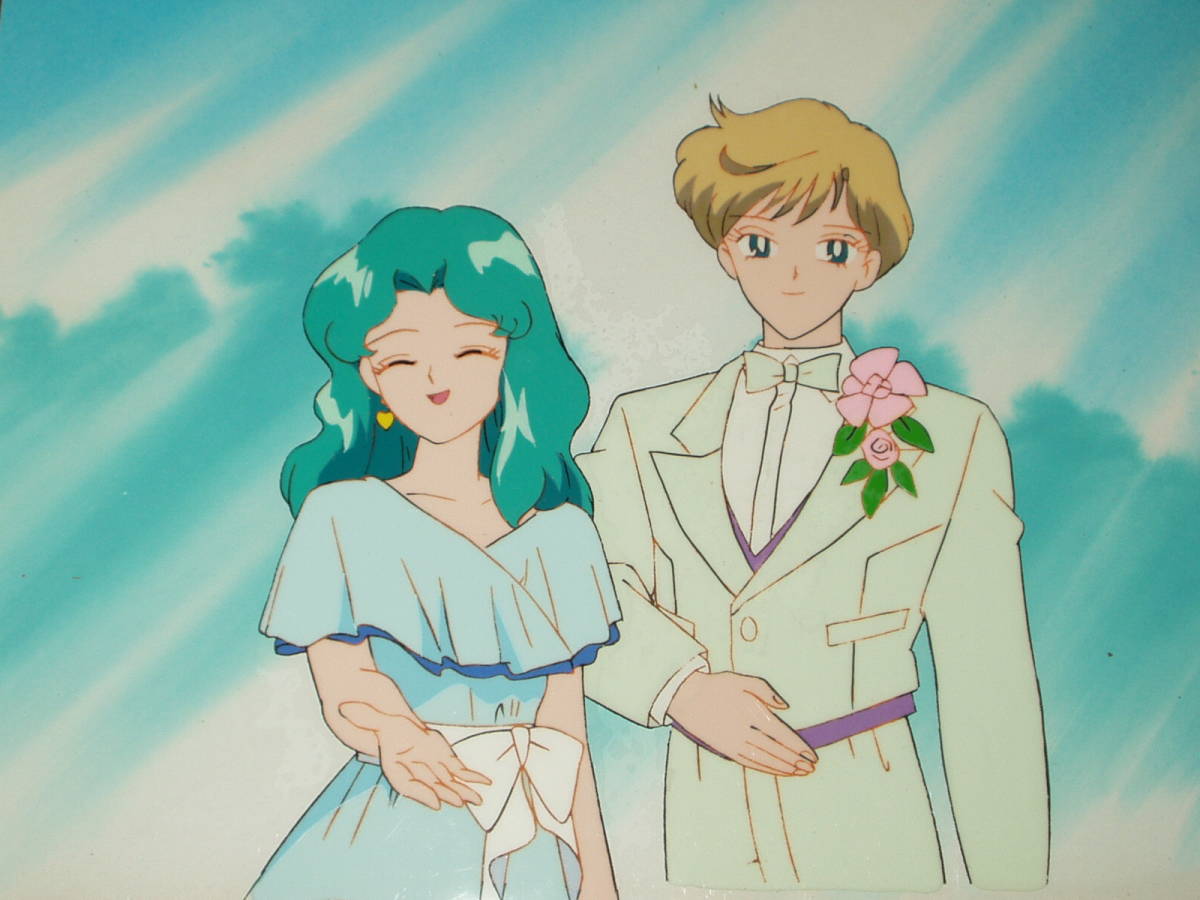

美少女戦士セーラームーン 天王はるか 海王みちる セル画

タイムセール

タイムセール

終了まで

00

00

00

999円以上お買上げで送料無料(※)

999円以上お買上げで代引き手数料無料

999円以上お買上げで代引き手数料無料

通販と店舗では販売価格や税表示が異なる場合がございます。また店頭ではすでに品切れの場合もございます。予めご了承ください。

商品詳細情報

| 管理番号 | 新品 :33446757 | 発売日 | 2025/01/04 | 定価 | 150,000円 | 型番 | 33446757 | ||

|---|---|---|---|---|---|---|---|---|---|

| カテゴリ | |||||||||

美少女戦士セーラームーン 天王はるか 海王みちる セル画

美少女戦士セーラームーン 天王はるか 海王みちる セル画

直筆背景付きセル画 2枚の組セルで貼りつきあり

セル画 動画 原画 その他アニメ製作の関連品は年数が経過しておりますので、基本様々な劣化があるものとお考え下さい。

落札されてから24時間以内に取引入力をして下さいますようお願いします。お支払いはヤフーかんたん決済のみで、直接の銀行振り込み、その他の支払い方法は一切対応出来ませんので必ずかんたん決済の支払い可能期間内でのお支払いをお願いします。

仕事の多忙さなどの関係でお支払い頂いてから発送手続きが完了するまでに最大7日かかる場合がございます。

海外発送の対応は到着日の指定と登録してある発送方法以外は基本対応出来ません。連絡などのやりとりは夜間になる事が多いです。

新規の方のご入札はお断りします。どうしてもお取引きを希望される方は質問欄より取引きを全うされる旨の連絡をお願いします。評価に悪い・非常に悪いなどがあり不安を感じる方は事前の通告なしに入札の削除、取引きの中止をする場合がございます。

ノークレーム、ノーリターン、ノーキャンセルでお願いします。

![タフト専用コンソールボックス[ 無骨箱]](https://static.mercdn.net/item/detail/orig/photos/m47028654964_1.jpg?1641594005)