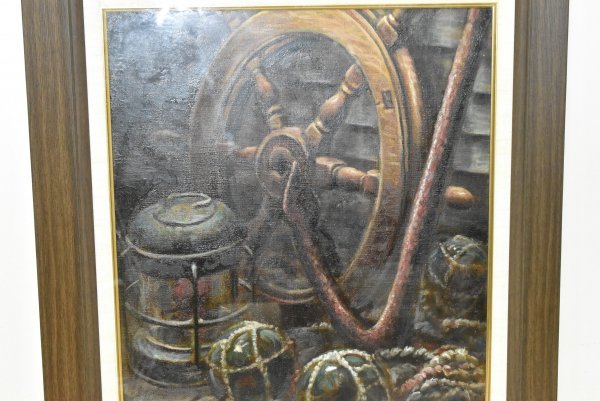

吉本哲 「潮騒」 油彩 F10号

タイムセール

タイムセール

999円以上お買上げで代引き手数料無料

商品詳細情報

| 管理番号 | 新品 :95721155 | 発売日 | 2024/02/06 | 定価 | 49,800円 | 型番 | 95721155 | ||

|---|---|---|---|---|---|---|---|---|---|

| カテゴリ | |||||||||

吉本哲 「潮騒」 油彩 F10号

吉本哲 「潮騒」 油彩 F10号

商品説明

注意事項

発送詳細

【お願い】商品状態を出来るだけ写真に撮れるようにしておりますが、一度他人の手に渡ったお品になりますので過度な期待をせずにオークションに参加ください。

トラブルの無いお取引を望んでいますので宜しくお願い致します。

■商品説明■

商品名:吉本哲 「潮騒」 油彩 F10号

商品管理番号:R-7056

■商品評価■

N新品S未使用品(保管時についた小傷があるお品)A使用感が少ない品(軽度の傷があるお品)B日常的に使用された一般的な品Cご使用は可能ですが難点がある品現状品現状でしか判断が出来ない品ジャンク品明らかに使用が困難になる場合がある品

★こちらの商品はA-Bランクになります。

※商品評価はあくまでも目安とお考えください。

■特記事項■

★絵画の一部に変色がございます。※写真をご参照ください。

※商品状態や気になったダメージ等は必ず写真や説明文に載せておりますが、写真に写りにくい傷や変色がある場合がございます。

※疑問点など写真で判断せずに必ずご入札前にご質問ください。

※一切のクレーム、返品等はご遠慮致します。ご了承頂ける方のみご入札ください。

※品になりますので、見落としの傷や汚れ等がある場合がございます。その際は現状優先になります。

※簡易清掃はしておりますが、クリーニング等はお客様自身でお願いします。

※写真にある物が全てとなります。

※その他、記載内容以外でご不明点等ありましたら必ず入札前にご質問下さい。

※上記内容をご理解・ご了承頂き、ご納得の上入札をお願いします。

商品説明

注意事項

発送詳細

※入札、落札された時点で記載事項全てにおいてご同意・ご納得頂いたと判断させて頂きます。

※オークション終了後、お客様から連絡後48時間以内に発送先等のご連絡を頂ける方、当方から送料の連絡後、かんたん決済のお

商品説明

注意事項

商品説明

注意事項

発送詳細

■!かんたん決済

こちらの商品案内は 「■@即売くん5.53■」 で作成されました。

この他にも出品しておりますので宜しければご覧ください。