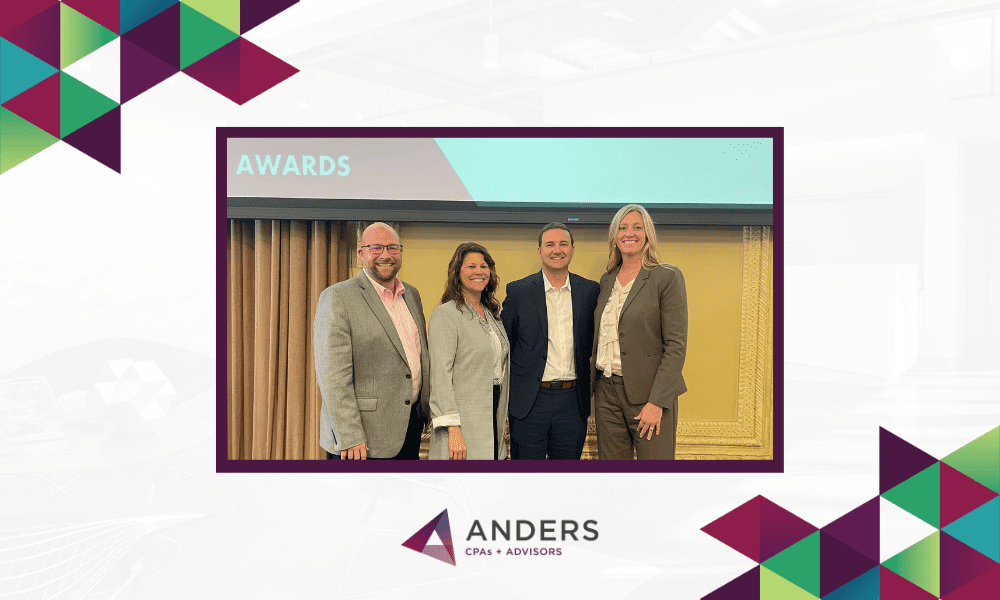

Anders is proud to announce that Julia Deien, Jason Gotway, Jane Maddox, CPA, and Sean McKenzie, CPA are being named partners of the firm, effective January 2024. The new group of partners was announced at the annual all-firm meeting in October, which the entire firm attends. They will join the rest of the partner group in guiding the firm and identifying new opportunities in addition to developing and maintaining client relationships.

About Julia Deien – Technology

Julia started her career at the firm in 2006 and has grown into a leadership role in Anders Technology. As the co-leader of Anders Technology, Julia leads a team that brings a dynamic technology approach to businesses. With a deep understanding of each client’s business goals and growth objectives, her team aligns their technology strategy to aid in meeting those goals. Julia has significant experience in the Microsoft 365 and Azure cloud environments and leads a team of Microsoft Certified engineers that move businesses to nimbler, cloud-based technology solutions. Using her expertise, she consults, designs, and implements solutions, making sure her clients not only adopt the cloud environment but also understand and are trained to maximize its full potential.

Julia graduated from Southern Illinois University – Edwardsville with a B.S. in Computer Management and Information Systems. Julia is on the Advisory Board for the Channel Company’s XChange Events. She is a treasurer for the International Association of Microsoft Channel Partners and is a member of the Computer Management and Information Systems Advisory Board for Southern Illinois University – Edwardsville. Julia also sits on the board for the Girl Scouts of Southern Illinois. Learn more about Julia Deien.

About Jason Gotway – Technology

The co-leader of Anders Technology, Jason has over 15 years of experience at the firm helping businesses enhance their technology and cybersecurity strategy. Jason has spent his career consulting with clients on strategies and products to protect them from evolving cybersecurity threats, whether they work in-office or remotely. Due to his level of knowledge on the topic, Jason frequently speaks on preventing cyber-attacks, educating companies and individuals on best practices for creating a secure network to avoid being victimized by cybercrime.

Jason completed his B.S. in Computer Management and Information Systems from Southern Illinois University Edwardsville. Jason serves as a board member for the Leadership Council Southwestern Illinois. Learn more about Jason Gotway.

About Jane Maddox – Tax

Jane joined the firm in 2011 and has over a decade of experience specializing in tax planning strategies for individuals and privately held businesses involved in real estate development, investment and construction. As a leader of the firm’s Real Estate and Construction group, Jane provides valuable consulting on topics from cost segregation analysis to the Qualified Business Income (QBI) deduction and overall tax compliance. She focuses primarily on serving real estate developers and operators, commercial real estate brokers and construction contractors, as well as their families. With prior experience providing interim controller support, Jane can see accounting from the client’s perspective, allowing her to understand and advise on the company’s entire financial situation. Jane also serves many individuals and privately held businesses in the legal industry.

Jane is a Certified Public Accountant and earned her Masters in Accountancy, specializing in taxation, from Southern Illinois University. She obtained her B.S. in Accountancy from the same university. Jane is a member of the Missouri Society of Certified Public Accountants (MOCPA) and the American Institute of Certified Public Accountants. Jane serves as the treasurer for the St. Louis chapter of Commercial Real Estate Women (Crew-St. Louis). Learn more about Jane Maddox.

About Sean McKenzie – Tax

Sean joined Anders in 2021 with over 20 years of experience in public accounting working with individuals and closely held businesses on tax strategies and compliance. Sean keeps up with evolving legislation and tax law changes to help his clients lower their tax liability today and strategize for the future. During and after the COVID-19 pandemic, Sean worked tirelessly to educate himself on programs designed to help businesses through the crisis, focusing on Employee Retention Tax Credits (ERTC). A natural people person, he enjoys building relationships with the individuals, families and businesses he works with and has served clients in a variety of industries, including construction, manufacturing, restaurants and private equity. He also builds relationships internally by coaching and mentoring tax staff to help them grow in their careers.

Sean is a Certified Public Accountant in the state of Missouri and holds a B.S. in Accounting from Saint Louis University. He is a member of both the American Institute of Certified Public Accountants (AICPA) and the Missouri Society of Certified Public Accountants (MOCPA). Learn more about Sean McKenzie.

Congratulations to all of our new partners!