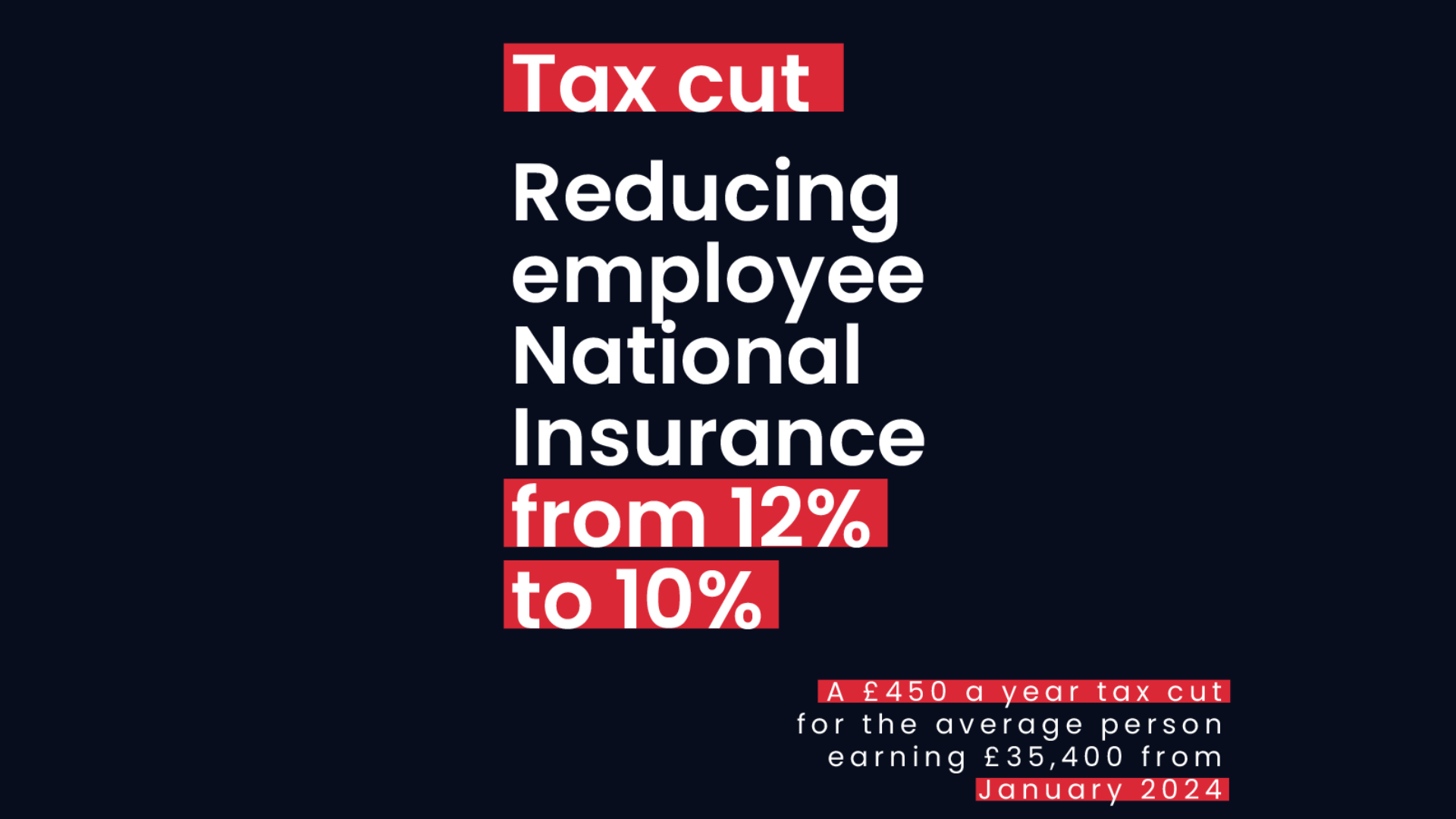

In the recent Autumn Statement 2023, Jeremy Hunt announced a reduction in National Insurance rates for both self-employed individuals and employees. The Class 1 National Insurance rate is set to decrease from 12% to 10%, effective from 6th January 2024.

2023/2024 Payroll Software Update

As these changes are applicable in the current 2023/2024 tax year, we are actively working on an update for the Qtac 2023/2024 payroll software to seamlessly integrate these adjustments before they take effect.

We recognise the urgency of this update, and our commitment is to keep you informed every step of the way.

Once the update is ready for installation, we will notify all customers promptly. You can also expect to receive these updates via live notifications within the software and via e-mail.

Dedicated Support at Your Service

Our dedicated support team is ready to assist you with any questions or concerns you may have. Whether you need clarification on the upcoming changes or any help during the update process, we are here to ensure your experience with Qtac remains seamless and hassle-free.

If you have any questions, please contact our support team on 0117 9353500 (Option 1) or via email at support@qtac.co.uk.