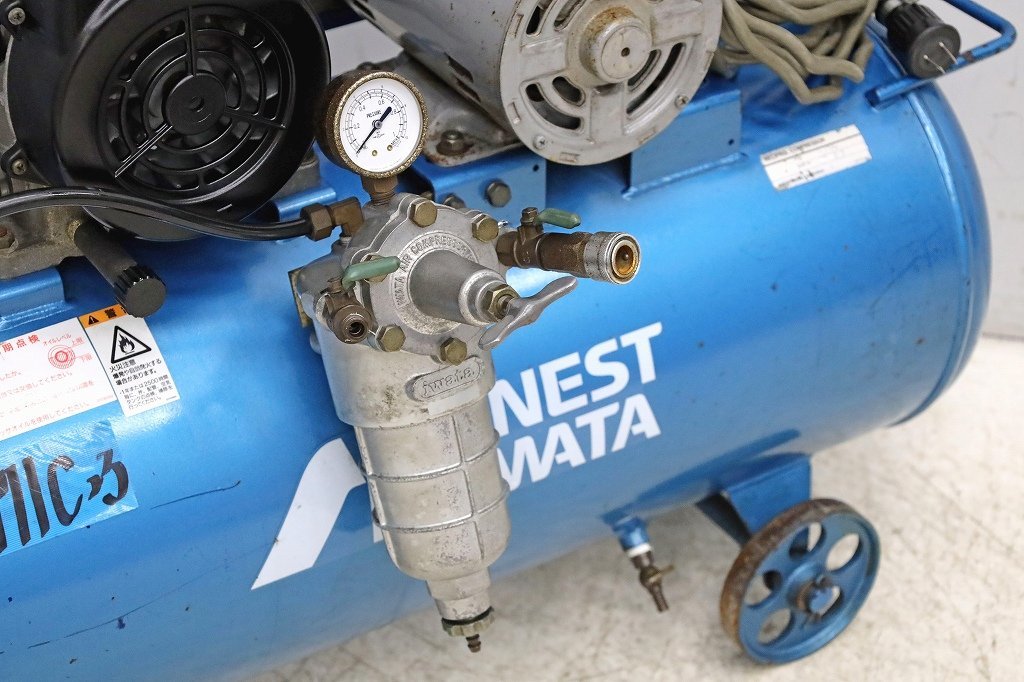

0771C23 ANEST IWATA アネスト岩田 レシプロエアーコンプレッサー SP-07PB 100V

タイムセール

タイムセール

999円以上お買上げで代引き手数料無料

商品詳細情報

| 管理番号 | 新品 :78244070 | 発売日 | 2024/04/19 | 定価 | 72,000円 | 型番 | 78244070 | ||

|---|---|---|---|---|---|---|---|---|---|

| カテゴリ | |||||||||

0771C23 ANEST IWATA アネスト岩田 レシプロエアーコンプレッサー SP-07PB 100V

ご入札前に【お取引・送料について】のご案内ページを必ずご確認ください。

◆送料が0円表示になっておりますが送料が必要 です◆

この商品は、サイズ( I )です。

※一部区域は直配区域ではないため中継区域となり、

別途中継料が加算されます。

サイズは高さ約70cm、横約94cm、奥行き約45cmです。

状態は全体的に使用感があります。

キズ、スレ、汚れなどがあります。

画像にて状態、付属品、仕様などよくご確認下さい。

画像にある物のみとなります。

簡単ではありますが清掃済みです。

動作チェックは通電確認のみです。

細かなチェックは致しておりません。

現状でのお渡しとなります。

いかなる場合でもこちらでは一切保証出来ません。

ご理解の頂ける方のみご入札下さい。

◆ 福山通運 送料表(元払い) ◆

km50km100km150km200km250km 300km350km400km450km500km 550km600km650km 700kmkm 支店

営業所

サイズ

・東海

・名古屋

・中川

・春日井

・岡崎

・岐阜

・名古屋北

・名古屋南

・名古屋西

・四日市

・西尾 ・豊橋

・松坂

・彦根

・大垣

・ぎふ関

・大垣南

・津 ・浜松

・袋井

・栗東

・しが八日市

・伊賀上野

・ぎふ郡上

・ぎふ下呂

・大津 ・静岡

・焼津

・京都

・京都南

・茨木

・摂津

・寝屋川

・松原

・新庄

・奈良

・ひだ高山

・敦賀

・福井

・枚方

・八尾

・静岡清水 ・裾野

・三島

・富士

・大阪

・大阪船場

・今里

・東住吉

・東大阪

・富田林

・堺

・泉大津

・阪神

・神戸

・神戸東

・綾部

・豊中

・神戸三田

・神戸中央

・新宮

・飯田 ・伊東

・松本

・伊那

・和歌山

・和歌山有田

・加古川

・加西

・姫路

・金沢東

・洲本

・金沢

・和田山

・徳島 ・八王子

・横浜

・横浜南

・横浜金沢

・伊勢原

・小田原

・西伊豆

・甲府

・韮崎

・長野

・上田

・龍野

・藤沢

・香寺

・豊岡

・備前

・高岡

・能登

・横浜西

・阿南

・さぬき ・阿波池田

・富山

・相模原

・東京

・東京北

・深川

・品川

・羽田

・市川

・埼玉

・所沢

・入間

・川越

・東久留米

・岡山

・都留

・飯山

・津山

・岡山東

・岡山南

・倉敷

・児島

・鳥取

・川口

・みなべ

・東京浦安流通

・北関坂戸 ・高松

・丸亀

・土浦

・千葉

・柏

・成田

・関東成田流通

・市原

・大宮

・東松山

・倉吉

・高梁

・福山港流通

・福山

・井笠

・福山北

・福山神辺

・茨城坂東

・加須 ・高知

・須崎

・大野原

・宇都宮

・栃木

・竜ヶ崎

・水戸

・群馬太田

・高崎

・深谷

・八日市場

・銚子

・木更津

・茂原

・新見

・米子

・松江

・府中

・尾道

・広島せら

・三原

・四国中央 ・今治

・新居浜

・日立

・鹿島

・南房総

・矢板

・上越

・東広島

・呉

・広島東

・広島

・三次

・広島海田

・広島宇品

・出雲 ・長岡

・中村

・松山

・松山東

・白河

・広島安佐南

・広島安佐

・広島北

・岩国

・廿日市

・塩沢

・大田 ・新潟

・郡山

・会津

・いわき

・大洲

・浜田

・江津

・柳井

・徳山

・王子新潟 ・宇和島

・福島

・山口

・防府

・益田 支店

営業所

サイズ

サイズ

( A ) 1300140014001400 1500150015001600 1600160017001700 17001700 サイズ

( A ) サイズ

( B ) 1500150016001700 1700180018001900 1900200020002100 21002200 サイズ

( B ) サイズ

( C ) 1600170017001800 1900200020002100 2200220022002300 24002500 サイズ

( C ) サイズ

( D ) 2000200022002300 2500270028003000 3100320033003500 36003700 サイズ

( D ) サイズ

( E ) 2200230026002800 3000320034003600 3800400042004400 45004800 サイズ

( E ) サイズ

( F ) 2900310034003700 4100440047005000 5300560059006200 65006800 サイズ

( F ) サイズ

( G ) 3200340038004200 4600500053005700 6100640067007100 74007800 サイズ

( G ) サイズ

( H ) 3800410045005100 5500600064006900 7400790082008700 91009700 サイズ

( H ) サイズ

( I ) 4800520059006600 7200780084009100 9700104001090011600 1220012900 サイズ

( I ) サイズ

( J ) 5500600068007600 84009200990010700 11500124001300013800 1450015400 サイズ

( J ) サイズ

( K ) 6300700079008800 9800107001150012600 13500144001520016300 1700018100 サイズ

( K ) サイズ

( L ) 790088001010011300 12600138001500016200 17400187001970021100 2210023500 サイズ

( L ) サイズ

( M ) 890097001100012300 13900152001640017900 19300206002190023300 2450026000 サイズ

( M ) サイズ

( N ) 10600118001350015100 17000186002030022000 23800256002700028900 3030032200 サイズ

( N ) サイズ

( P ) 12300138001580017900 20000219002390025900 28000302003190034100 3580038100 サイズ

( P ) サイズ

( Q ) 14200158001820020600 23100253002760030000 32400349003690039500 4150044100 サイズ

( Q ) サイズ

( R ) 16000179002070023400 26200288003140034100 36900398004200045000 4730050400 サイズ

( R ) km 50km100km150km200km250km 300km350km400km450km500km 550km600km650km700km km

km 750km800km850km900km950km 1000km1100km1200km1400km1500km 1600km1700km1800km1900km km 支店

営業所

サイズ

・仙台中央

・大河原

・萩

・宇部

・下関

・米沢 ・古川

・長門

・北九州

・飯塚

・北九州南

・仙台泉 ・山形

・福岡

・福岡流通

・福岡南

・中津

・鳥栖

・大野城

・甘木

・福岡箱崎

・岩手平泉

・石巻 ・大牟田

・大分

・佐賀

・唐津

・北上

・久留米

・山形新庄 ・盛岡

・熊本

・熊本東

・佐世保

・庄内 ・八代

・長崎

・王子横手 ・八戸

・秋田

・大館

・宮崎

・えびの

・延岡

・出水

・九州川内

・鹿児島空港

・王子大館 ・函館

・青森

・弘前

・鹿児島

・都城

・知覧

・鹿屋 ・室蘭 ・苫小牧

・三笠

・札幌

・石狩

・旭川 ・帯広 ・北見 ・釧路 支店

営業所

サイズ

サイズ

( A ) 1700180018001800 1800190020002100 2200230024002500 26002700 サイズ

( A ) サイズ

( B ) 2200230023002400 2500250027002800 3200330035003600 38003900 サイズ

( B ) サイズ

( C ) 2500260027002800 2800290031003300 3600370039004100 42004400 サイズ

( C ) サイズ

( D ) 3900400041004300 4400460049005300 5900630066006900 72007600 サイズ

( D ) サイズ

( E ) 4900510053005500 5800600065007000 7900840089009400 990010400 サイズ

( E ) サイズ

( F ) 7000740076008000 84008800950010300 11800126001330014100 1480015600 サイズ

( F ) サイズ

( G ) 8000850088009200 9700101001100011900 13600145001540016300 17200 18000 サイズ

( G ) 260cm

( H ) 10000105001090011500 12100127001390015000 17400186001970020900 2210023300 サイズ

( H ) サイズ

( I ) 13400142001470015500 16300171001870020400 23600253002690028500 3010031800 サイズ

( I ) サイズ

( J ) 16000169001760018500 19500205002240024400 28400303003230034300 3620038200 サイズ

( J ) サイズ

( K ) 18900199002080021900 23000242002650028900 33500359003820040500 4290045200 サイズ

( K ) サイズ

( L ) 24600260002700028500 30100316003470037800 44000471005020053300 5630059400 サイズ

( L ) サイズ

( M ) 27200288003000031700 33400351003860042000 48900524005580059300 6270066200 サイズ

( M ) サイズ

( N ) 33700357003720039200 41400436004790052200 60800652006950073800 7810082500 サイズ

( N ) サイズ

( P ) 39800422004400046500 49000516005670061800 72100772008230087400 9250097600 サイズ

( P ) サイズ

( Q ) 46100490005100053900 56900599006590071900 839008990095900101900 107900113900 サイズ

( Q ) サイズ

( R ) 52700559005820061600 64900684007520082000 95600102400109200116000 122800129600 サイズ

( R ) km 750km800km850km900km950km1000km 1100km1200km1400km1500km1600km1700km 1800km1900km km

発送方法 ◆発送は福山通運の送料元払いにて発送致します。

※のシステム上、ご購入手続き時に送料0円で表示されますが、

送料無料ではありません。ご注意ください。

また、発送方法の変更、着払いは出来ません。

(沖縄、離島の方は送料表に記載がない場合もございます。

送料のお見積りを致しますので事前にご質問下さい。)

パレットに載せて発送になる物もございます。

フォークリフト等荷下ろしの機械をご準備下さいませ。

福山通運ホームページです。

◆法人・個人事業主様宛のみの発送となります。

個人様名では発送が出来ませんので、

法人・個人事業主様以外の方は

営業所止めのみとなります。

法人名(屋号)のお知らせをお願い致します。

個人事業主様も必ず屋号のお知らせをお願い致します。

(個人事業主様でも個人様名のみの場合は発送となります。)

営業所止めをご希望される方はご連絡下さい。

ご指定の営業所の方までお引取りをお願い致します。

(個人様名の場合は営業所止めのみ発送可能です。)

◆なお、一部区域は直配区域ではないため中継区域となり、

別途中継料が加算されます。

発送先のご住所をお知らせ頂いた上で、

送料の合計金額をお伝えさせて頂きます。

中継区域に該当の方は事前に質問欄にてご確認して頂く等、

ご納得の上でのご入札のみでお願い致します。

詳しくは下記をご参照下さい。

中継区域について

◆集荷の関係上、即日・翌日発送が出来ない場合がございます。

最短にて発送致しますが、お急ぎの場合は

ご入札をご遠慮下さいますようお願い致します。

梱包資材の回収はできませんので、お客様で処分いただきますよう

お願い致します。

◆ 落札日より一週間以内でのお取引をお願いしております。

(同梱ご希望の場合は最初の商品落札日より一週間以内になります。)

◆落札後、直接お引取りも可能です。

落札から一週間以内でのお引取りをお願い致します。

購入手続きの際、店頭受け取りを選択していただくか

取引メッセージにてご連絡下さい。

直接お引取りの場合も購入手続きをしていただかないと

商品をお渡しする事は出来ません。

(落札から2日以内に購入手続きを行って下さい。)

営業時間は13-18時となりますので、

お時間内にお越し下さいますようお願い致します。

お引き取り商品に関しての梱包は致しません。

積み込みに必要なロープ・資材・道具、また搬出に関しての解体・必要な工具等は、

落札者様にてご用意下さい。

商品サイズをご確認の上、積み込みしやすい車両のご準備をお願い致します。

大型車も進入可能です。

引取商品のサイズや重量に対し、積載が困難と思われる車両で来られた場合、

積載のお手伝いをお断りする場合がございますので、予めご了承下さい。

店頭お引取時、商品へのクレーム・値段交渉などはお受けできません。

商品詳細やご不明点のご質問は入札前にしていただくようお願い致します。

トラブル防止のため、お振込み・かんたん決済での事前決済をお願い致します。

◆領収書・請求書・納品書の発行は基本的には致しておりません。

お振り込みの際に発行される「ご利用明細」をご利用頂けますよう

お願い致します。

お ◆PayPay銀行

◆三菱UFJ銀行

◆ゆうちょ銀行

◆クレジット決済

◆PayPay払い

◆現金にてお 注意事項 ◆商品状態の見落としがある事がございますので、品である事のご理解の程、

宜しくお願い致します。

基本的に商品の保証は出来ませんのでご了承下さいませ。

ご入札頂いた時点で承諾して頂いたものとみなします。

◆最近ご落札(ご入札)後に発送方法の変更、

商品の状態確認等のお問合せがございます。

判らない事は必ずご入札前にご質問下さい。

ご落札後の確認事項に関しましては、対応出来ない場合がございます。

ご質問等につきましては当方で出来る限り、対応させて頂きます。

但し、内容及び終了時間の24時間以内のお問合せに付きましては、

対応出来ない場合がございますのでご了承下さい。

◆最近評価がまだない『新規』の方のイタズラ入札が増えております。

『新規』の方のご入札は当方で削除致します。

必ず約束を守り責任を持ってお取引して頂ける方は質問欄にてお問合せ下さい。

質問欄にてお問合せを頂けていない方がご入札された場合、ご入札を削除致します。

◆オークション終了後、2日以内に返信のメールを頂けない方は、

ご入札をご遠慮下さい。

新規の方は翌日ご連絡頂けない場合削除させて頂きます。

◆落札日より1週間以内でのお引取り、発送とさせて頂きます。

基本的にはバラ売りは致しません。

入札者様及び落札者様の方の評価に『悪い』評価が有る場合、

評価内容により当方の判断にてキャンセル、削除させて頂く場合がございます。

ご了承下さい。

◆店頭でも販売している為オークションを取り消す場合がございます。

(1,000円スタートの商品は対象外です。)

◆なお、ジャンク品に関してはいかなる場合でも、保証は出来ません。

ご理解の頂ける方のみご入札下さい。

◆出品中の商品は別の倉庫に保管しており、店頭には並んでおりません。

商品を確認したい場合は必ずお、メール、質問等で事前予約をお願い致します。

ご予約されずにご来店いただいても現物確認対応が出来ない場合がございます。

また、リフトや大型機械などはトラブル防止のため事前の動作確認、

現物確認をお勧め致します。

遠方でご来店できず落札された場合でも返金・返品は一切承っておりません。

当店のホームページ 愛知県公安委員会 第543811401800号

![[期間限定セール中]ひらがな 切り文字表札[雅楽] ステンレス 浮き文字 アイアン表札](https://crp01.c4a.im/images/item/14088176/35b0059d82dad142e836d077b9661d55c2c81f724822217487263c6741756434?d=583x585)