The Internal Revenue Service plans to propose regulations on how to claim the energy efficient home improvement credit, including a requirement under the Inflation Reduction Act for a product identification number, and it’s asking for comments ahead of time on the PIN requirement.

On Friday, the Treasury Department and the IRS released

Starting Jan. 1, 2025, taxpayers who claim the tax credit also need to satisfy the PIN requirement for some kinds of products. An item will only qualify for the credit if it’s produced by a qualified manufacturer, and if the taxpayer includes the item’s qualified PIN on their tax return.

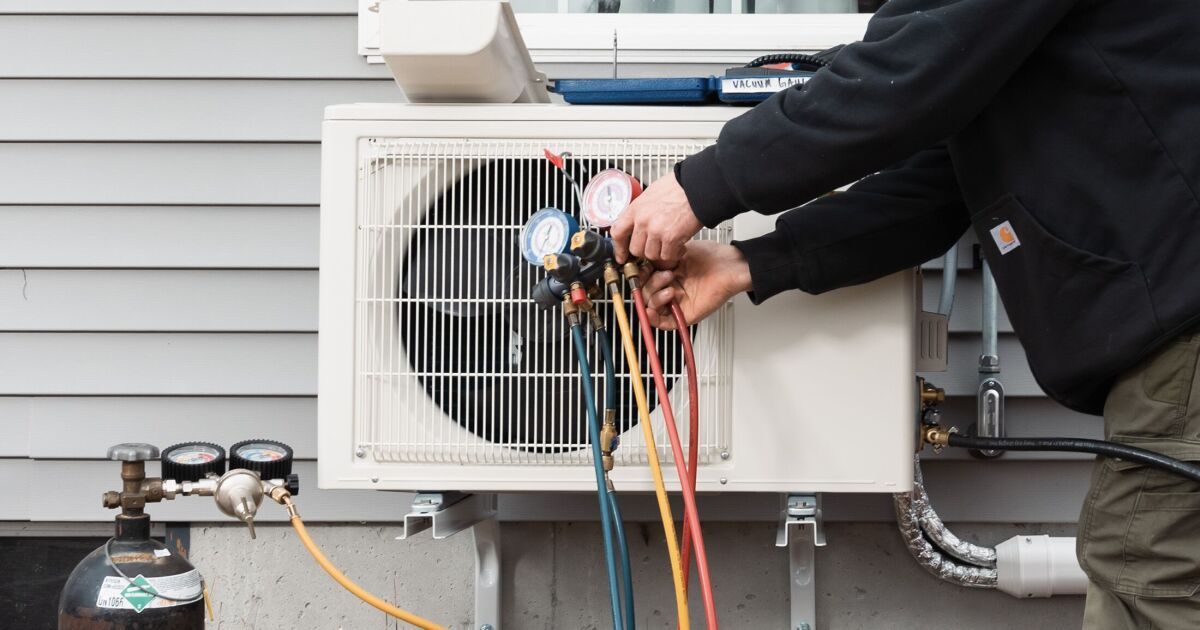

Tristan Spinski /The Washington Post/Getty Images

In Notice 2024-13, the IRS discusses a PIN assignment system it’s currently considering and asks for comments on several general and specific questions on the new PIN requirement. Any comments will be taken into consideration by the IRS and the Treasury as they develop proposed regulations to implement the PIN requirement. Ideally, comments should be sent by Feb. 27, 2024. After that date, comments will be considered only if they don’t delay the guidance.

The tax credit dates back to the Energy Policy Act of 2005 to provide the nonbusiness energy property credit for the purchase and installation of certain energy efficient improvements in taxpayers’ principal residences. That law added Section 25C to the Internal Revenue Code and has been amended several times over the years, most recently by Section 13301 of the Inflation Reduction Act, which renamed this provision the “energy efficient home improvement credit.”

Before the IRA was enacted last year, Section 25C had expired on Dec. 31, 2021. Section 13301(a) of the IRA amended Section 25C(g) to make the Section 25C credit available from Jan. 1, 2022, through Dec. 31, 2032. (3) Section 13301(b) of the IRA amended Section 25C(a) to allow a credit for 30% of the amounts paid or incurred by individual taxpayers during the tax year for qualified energy efficiency improvements and residential energy property expenditures.

As amended by the IRA, the Section 25C credit is generally limited to an annual cap of $1,200. Within this $1,200 limitation, there are some further annual caps for certain categories of improvements: $600 for any item of qualified energy property, as defined in Section 25C(d)(2); $600 for exterior windows and skylights; $250 for any single exterior door; and an aggregate of $500 for all exterior doors.

Despite the $1,200 annual limitation and other limitations, the amounts paid or incurred for heat pumps, heat pump water heaters, biomass stoves and biomass boilers are allowed a separate, aggregate annual credit of up to $2,000.