IT Department released Key Highlights of Finance Bill 2024

The Income Tax Department has released the key Highlights of the Finance Bill, 2024.

The Highlights are:

- Proposed Changes in Tax Rates

- Proposed amendments w.r.t. Deductions and Exemptions

- Proposed amendments w.r.t. Faceless Scheme

- Proposed amendments w.r.t. TCS

- Proposed amendments w.r.t. Outstanding Tax Demand

Proposed Changes in Tax Rates

No changes in tax rates are proposed by Finance Bill, 2024.

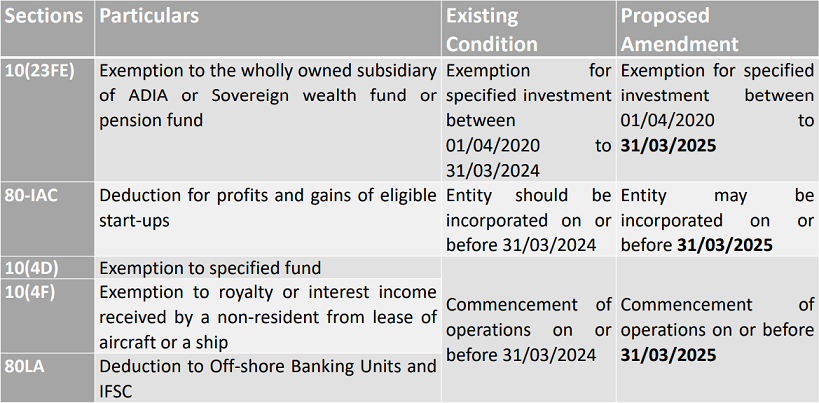

Proposed amendments w.r.t. Deductions and Exemptions

The following amendments are proposed for deductions/ exemptions:

Proposed amendments w.r.t. Faceless Scheme

To implement the faceless regime in Section 92CA, Section 144C, Section 253 and Section 255, it was provided that the CBDT shall issue the necessary directions by 31/03/2024.

It is proposed to amend the aforesaid Sections to allow the issue of necessary directions by 31/03/2025.

The following faceless schemes are covered in the above sections:

Proposed amendments w.r.t. TCS

The Finance Bill proposes the necessary amendments to Section 206C(1G) to restore the threshold of INR. 7 lakhs per financial year for TCS on all categories (except the sale of overseas tour program packages) of foreign remittances made under the Liberalised Remittance Scheme (LRS) w.e.f. 01-10-2023.

In the case of ‘sale of overseas tour program package’, the TCS rate shall be 5% for remittances up to INR 7 lakh, and 20% for remittances exceeding INR 7 lakhs.

The Finance Bill, 2024 proposes to insert the sixth proviso to provide that the collection of tax at source during the period 01-07-2023 to 30-09-2023 shall be in accordance with provisions of Section 206C(1G) as they stood on 01-04-2023.

Proposed amendments w.r.t. Outstanding Tax Demand

In the budget speech, Hon’ble Finance Minister proposed to withdraw or waive off the small, unresolved, unverified, or disputed direct tax demands pertaining to the financial years up to 2014-15.

The proposal aims to waive off the recovery of the old outstanding demands up to INR 25,000 for the period up to financial year 2009-10 and up to INR 10,000 for financial years 2010-11 to 2014-15

Join StudyCafe Membership. For More details about Membership Click Join Membership Button

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe’s WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!”