So, you have a nice work setup at home. Does that mean you get to write it off on your taxes? If you’re new to working remotely or running a small business from home, it’s understandable that you have some questions about how that impacts your taxes and which deductions you might be entitled to.

Unfortunately, for remote workers, the shift to work from home–whether forced or optional–doesn’t qualify for a tax write-off of their workspace as a home office. But for self-employed individuals, the home office deduction could be a great opportunity to take advantage of.

Before you start gathering all those invoices for tech, utilities, and other home office expenses, it’s important to make sure you qualify.

We’ve laid out the basics and different requirements to help you determine if you can take advantage of the home office deduction. Let’s dive in.

What is the home office tax deduction?

The home office tax deduction allows qualified taxpayers to write off certain home expenses related to their business use of their home when they file their taxes. To claim the home office deduction on your tax return, taxpayers must exclusively and regularly use part of their homes or a separate structure on their property as their main and primary place of business.

Prior to the Tax Cuts and Job Act (TCJA) passed in 2017, employees could deduct unreimbursed employee business expenses, including deductions for the home office. However, for the tax years 2018 to 2025, these deductions for employee business expenses have been suspended.

So, if you’re an employee working remotely for an employer rather than a business owner, self-employed, or 1099 contractor, you likely don’t qualify for the home office tax deductions.

What are the main criteria for the home office deduction?

Figuring out whether you qualify for this deduction can seem overwhelming, but it’s actually pretty straightforward once you look at the requirements individually.

Generally, to qualify for this tax deduction, the space you’re trying to claim as a home office must meet one of the following criteria:

Exclusive & regular use

This means you must use a portion of your house, apartment, mobile home, condominium, boat, or similar structure for your business on a regular basis. This also includes structures on your property, such as an unattached:

- Barn

- Studio

- Greenhouse

- Garage

This doesn’t include any part of a taxpayer’s property that is being used exclusively as a hotel, motel, inn, rental, or similar business.

Exclusive & regular meeting space

An exclusive and regular meeting space, also known as a principal place of business, means your home office must be used regularly, be a principal location of your business, or a place where you regularly meet with:

- Patients

- Customers

- Clients

This is common for some doctors or advisers who have small practices, but there are some exceptions. Daycare and storage facilities don’t apply. The IRS provides an example of an attorney who regularly uses a room to prepare his work but is also a den for the family, which means it doesn’t qualify for the deduction.

Separate, unattached structure

Exclusive & regular use of a separate, unattached structure from your home where you maintain trade or business.

For example, if your home office is in a separate, unattached structure–like a craftsman working in his detached garage turned workshop–you don’t have to meet the principal-place-of-business or the deal-with-clients test. You can qualify for the IRS home office deduction as long as you pass the exclusive and regular use tests.

Exclusive & regular use for storage, rental, or daycare

The regular and exclusive use of storage space for inventory or product samples being used in your trade or business of selling products at retail or wholesale, as long as your home is the sole fixed location of such business or trade for rental use or as a daycare facility.

Exceptions to the exclusivity rule include storage being used for samples or items for sale, and for daycare facility operations. For these, it’s the ‘regular’ component that is required to be proven.

What qualifies as a business?

Whether your endeavors qualify you for a home office deduction depends on the regular-use test. The more substantial the activities, such as time and effort invested and generated income, the more likely you are to pass the test.

For the purposes of a home office tax deduction, profit isn’t the only criteria, although making money from your efforts is a prerequisite.

For example, if you use your living room exclusively to take care of your personal investment portfolio, then you can’t claim deductions for a home office because your activities as an investor don’t qualify as a business. Taxpayers who use a home office exclusively to manage rental properties may qualify for home office deduction but as a property manager rather than an investor.

What qualifies as a home office?

A home office must be either the principal location of your business or a place where you regularly meet with clients, patients, or customers. To qualify for the IRS home office deduction, you must exclusively use the area for business.

An example the IRS gives about the severity of the exclusive-use requirement is a home office used for full-time business that is worked ten hours a day, seven days a week. If you let your children use the office to do their homework, this violates the exclusive-use requirement and forfeits the chance for a home office deduction.

What all can you deduct?

Deductible expenses for business use of your home include the business portion of:

- Real estate taxes

- Mortgage interest

- Rent

- Casualty losses

- Utilities

- Insurance

- Depreciation

- Maintenance

- Repairs

Generally, you can’t deduct expenses for parts of your home that aren’t used for business, for example, lawn care or a workout room.

If you’re considering standard vs. itemized deductions, determining if you qualify for a home office write-off is important.

How much can you deduct for a home office?

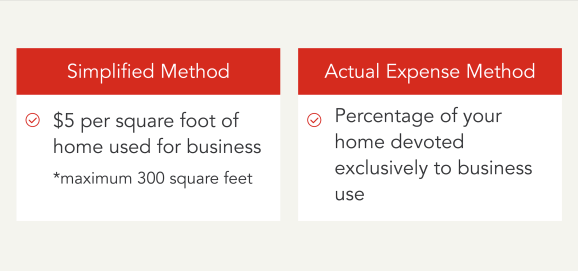

Figuring out how much you can deduct for a home office isn’t as complicated as it sounds. Taxpayers who qualify may choose one of two methods to calculate their home office deduction.

Actual expense method

Taxpayers using the actual expense method (required for tax years 2012 and prior) instead of the simplified method must determine the actual expenses of their home office. These expenses may include:

- Mortgage interest

- Insurance

- Utilities

- Repairs

- Depreciation

When using the actual expense method to deduct home office expenses, you base it on the percentage of your home devoted exclusively to business use. So, for the room used for conducting your business, you’ll need to figure out what percentage of your home that amounts to.

For example, let’s say you use a room that’s 200 square feet for business operations. If your house is 1,500 square feet, the percentage of your home dedicated to business use would be roughly 13%.

That means that you can write off 13% of expenses like your mortgage interest and utilities, among the others, as business expenses. Using an example of a total of $4,500 for the above-mentioned expenses, that would be a write-off of about $585.

Let’s break down that math really quickly:

% business expenses x total expenses = home office expenses

.13 x $4500 = $585

Simplified method

The simplified method can significantly reduce the burden of recordkeeping by allowing a qualified taxpayer to multiply a prescribed rate by the allowable square footage of the office instead of determining actual expenses.

The simplified option has a rate of $5 per square foot for business use of the home. The maximum size for this option is 300 square feet and has a maximum deduction of $1,500.

So, for example, let’s say you use 200 square feet of your home for business operations. The home office deduction using the simplified method would be $1,000.

While, in this example, the simplified method results in a larger deduction, that’s not always the case. It will depend on your specific expenses and which actually apply to the area of your home used for your business. For example, you can’t include repairs that were done to another part of the house.

Important considerations

Regardless of the method used, when filing for deductions for your home office, it’s important to note that you can’t deduct business expenses in excess of the gross income limitation.

It’s also important to consider the qualifications for a home office deduction when assessing your business use of your home. You’ll want to factor in depreciation and make sure you’ve kept detailed records, as eligibility might change from one year to the next.

3 responses to “Can I Take the Home Office Deduction?”