夢小説 ドリーム小説

タイムセール

タイムセール

999円以上お買上げで代引き手数料無料

商品詳細情報

| 管理番号 | 新品 :68549165 | 発売日 | 2024/08/03 | 定価 | 1,054,000円 | 型番 | 68549165 | ||

|---|---|---|---|---|---|---|---|---|---|

| カテゴリ | |||||||||

夢小説 ドリーム小説

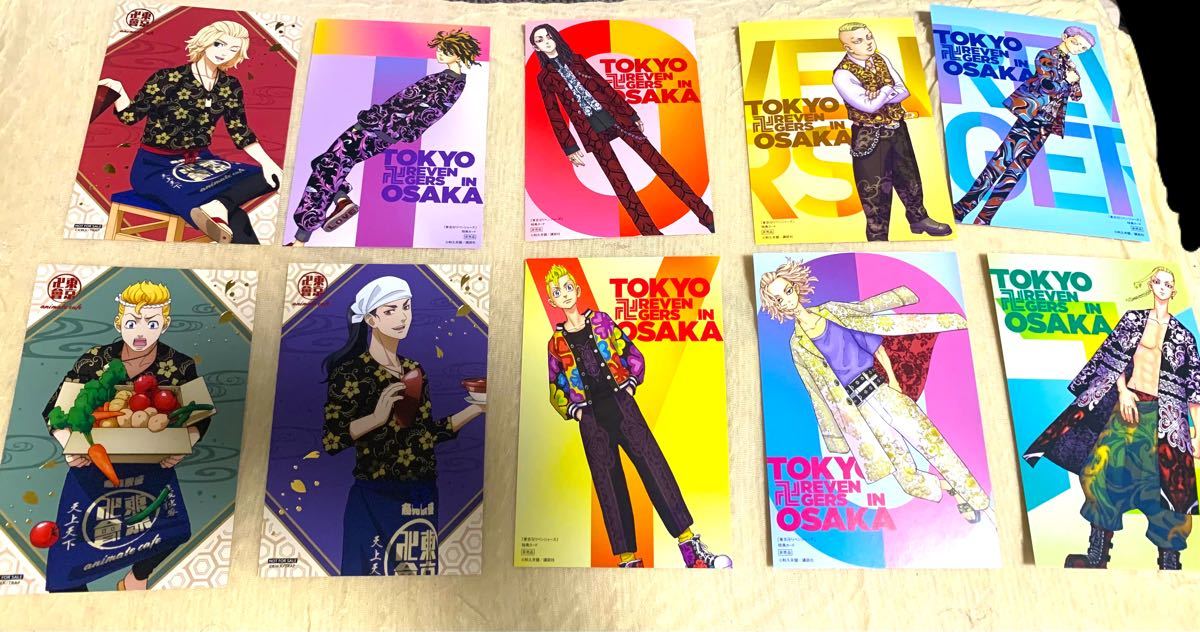

リピート割あり 〜†夢の世界へようこそ†〜 1.まずはコメントください。 2 .専用をお作ります。 3.設定や名前などコメント下さい。 4.お支払をお願いします 5.制作にとりかかります。 6.制作完了後発送 評価をお願いします。 郵送代300円いただきます。 2作品以上纏めてオーダーで無料! アニメや漫画キャラではなく現実の片想いの相手と〜なども可! ✱制作開始できるのは1か月〜3ヶ月程です!(予約状況によります) 依頼を頂いてから2ヶ月以内に制作を開始できれば、と思っておりますが文字数によってそこから1,2ヶ月ほどお時間をいただく場合もございますのでご了承くださいませ。(お相手様にもよります) ご注文順に制作させていただきます! わからないアニメなどは口調や性格などを見てから制作に入らせていただきます!追加設定などいつでもいってください! 短編集も可!文字数でお値段計算します ほのぼの.嫌われ.取り合い.片想い.失恋.両想い リクエストください *最後から3枚目は画像でのみのサンプルです。 印刷時は最後のような感じの冊子になります! 夢主様の幸せな夢への手助けをさせていただきます。 ドラゴンボール/リアルアカウント/ONE PIECE/ハイキュー!!/HUNTER×HUNTER/銀魂/名探偵コナン/鬼滅の刃/東京リベンジャーズ/弱虫ペダル/僕のヒーローアカデミア/地縛少年花子くん/トモダチゲーム/FAIRY TAIL/暗殺教室/VOCALOID/踊り手/歌い手/YouTuber/君に届け/こちら亀/超余裕/約束のネバーランド/Dr.STONE/原神/とある科学の超電磁砲/スパイファミリー/リゼロ/ワンパンマン/魔入りました!入間くん/山田くんとLv999の恋をする/墜落JKと廃人教師 上記以外ももちろんコメント下さい♪言っていただければ知っているの可能性高いです! 誤字、脱字、訂正など評価前にお知らせください(*´ω`*) #夢小説 #ひめshop #夢小説ページ #郵送