The Public Company Accounting Oversight Board is proposing a new rule to prevent auditing firms from making false or misleading statements about being registered or overseen by the PCAOB.

The proposed PCAOB Rule 2400, False or Misleading Statements Concerning PCAOB Registration and Oversight, would prevent firms from promoting their PCAOB registration in a way that could mislead clients, investors and others. The Sarbanes-Oxley Act of 2002 requires auditing firms to register with the PCAOB if they want to audit public companies and broker-dealers and submit to inspections. Registration enables the PCAOB to keep track of the firms that are eligible to do those audits and the inspections allow the audit regulator to monitor how they’re doing. However, some firms seem to be misrepresenting what it means to be registered with the PCAOB.

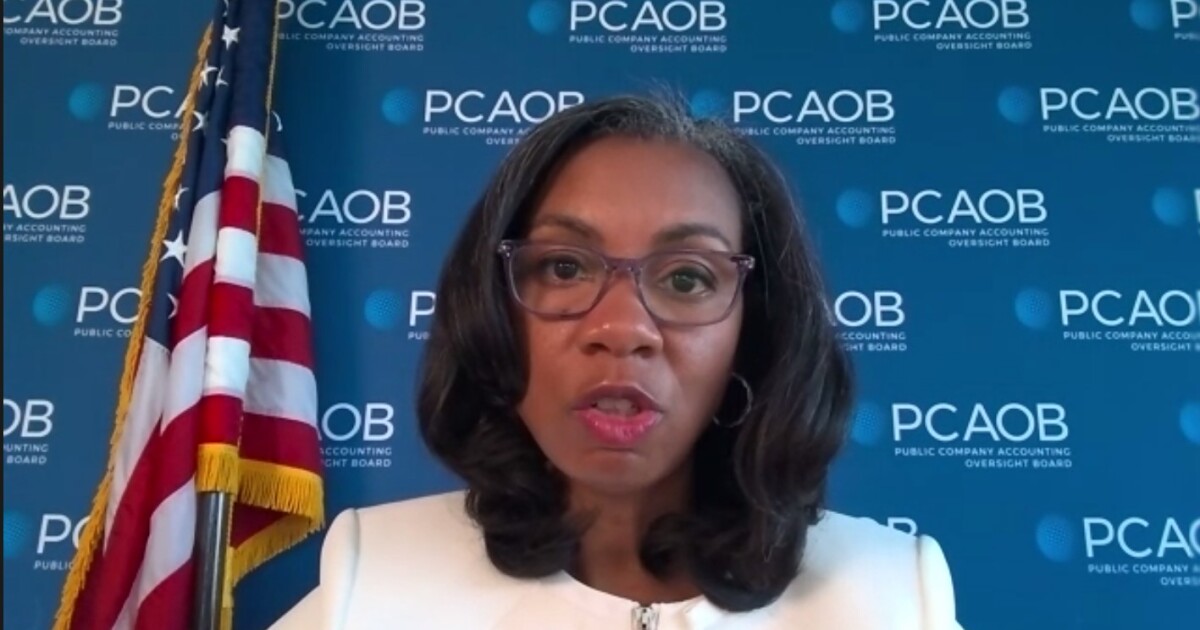

“PCAOB registration is not a ‘seal of approval’ or ‘mark of excellence,’ as some firms have advertised on their websites, said PCAOB chair Erica Williams in a statement during a meeting Tuesday to consider issuing the proposed rule. “The PCAOB does not sponsor, recommend or endorse firms. And PCAOB registration is not a system for grading the quality of a firm’s professional work.”

She noted that just because a firm is registered with the PCAOB doesn’t necessarily mean all or any of its work falls under the scope of PCAOB’s oversight authority, nor does it guarantee its work is conducted in compliance with PCAOB rules and standards.

“The PCAOB’s oversight authority extends only to a firm’s practice in connection with audits of public companies or SEC-registered broker-dealers,” said Williams. “Nearly half of firms registered with the PCAOB are not engaging in any audit-related work subject to PCAOB oversight. And most others have some work that falls within the PCAOB’s scope and some that does not.”

She pointed to proof-of-reserve reports that were offered by some auditing firms to cryptocurrency companies as an example of the type of services PCAOB-registered firms can provide that fall outside the PCAOB’s oversight authority. Last year, after

“Under the proposed rule, a firm issuing a proof-of-reserve report and touting its PCAOB registration in that report would be considered misleading, unless the firm also states that its work on the proof-of-reserve report does not fall within the PCAOB’s jurisdiction,” said Williams.

The proposed rule would generally prohibit a registered firm and its associated persons from making false or misleading statements concerning the firm’s PCAOB registration status, including the extent of the PCAOB’s oversight of a firm’s services, according to Williams. It will include a list of scenarios that would violate the general prohibition, including implying the PCAOB sponsors, recommends or otherwise endorses the firm or its services, or connecting PCAOB registration to services not subject to PCAOB oversight. It would also codify the PCAOB’s current practice of considering any prior false or misleading statements made by a firm or its personnel regarding the firm’s PCAOB registration status, including the extent of PCAOB oversight of the firm, when reviewing a firm’s registration application.

The proposal will also include a new mechanism under an existing PCAOB Rule 2107, Withdrawal from Registration, so if a firm fails to both file annual reports with the PCAOB and pay annual fees to the PCAOB for at least two reporting years in a row, the PCAOB can consider the firm to have withdrawn from registration.

“PCAOB registration is not a marketing gimmick for firms,” said Williams. “This rule would protect investors from misinformation by ensuring there are consequences when firms misrepresent their PCAOB registration status or what it means.”

She is encouraging the PCAOB’s stakeholders to read the proposal and provide their perspectives.

NOCLAR standard

Separately, the PCAOB announced Monday that it will hold a

The PCAOB announced Tuesday that it’s reopening the comment period on the NOCLAR standard until March 18 and will hear more feedback on the proposal at the virtual roundtable on March 6.