The trucking industry is a backbone for economies worldwide, but trucking business owners know well that the accounting process and practices within the industry are…dicey, at best. While profit margins can be heavily impacted by increasing operating costs for things like labor, fleet maintenance, and fuel, a company’s accounting practices (or lack thereof) tend to contribute significantly to business failure.

Accounting software is exceptionally important for transportation businesses and owner-operators alike, but it’s not going to solve every problem. Your accounting management software only adds value if you’re maintaining proper financial records, cash flow statements, tax planning strategies, and forecasting practices.

That said, everything your business does comes down to cash. Not just how much you have on hand, but how effectively you’re keeping track of it and ensuring your cash management practices and financial statements allow you to run your business with as few surprises as possible.

4 Essential Cash Accounts for Transportation Accounting

Having a solid amount of cash on hand will help protect your business against some unexpected disruptions and events, but it’s not where you should stop. Small business owners and owner-operators need different cash accounts for different purposes. Cash-centric bookkeeping practices often lean heavily on separating and maintaining different cash accounts.

Four cash accounts matter most in transportation accounting:

- Operating cash (account for paying bills)

- Cash reserves (your cash-on-hand for occasional needs)

- Tax reserves (giving Uncle Sam his due)

- Line of credit (for the biggest emergencies)

Managing cash accounts is where many small logistics companies struggle the most and one of the primary reasons companies hire CPAs to help handle their books. If you’re not at that step yet, taking this approach will help you get started before you start working with professional accounting services.

Although it’s always better to hire a financial management service that specializes in your industry and understands all of the financial and accounting needs common for a trucking company or independent owner-operator, every business needs to start somewhere until they reach that point where managed services make sense.

These practices will help you get started and allow you to quickly ramp up the quality of your bookkeeping once you do work with an accounting firm.

Operating Cash: Paying Bills on Time

With an Operating Cash account, you simply move money from your where you receive revenue from Accounts Payable into your account for Operating Cash. This is one of the simpler and easier-to-understand cash accounts that doesn’t require as much math on your part.

Your business will suffer quickly if you’re not properly taking care of your operating costs. But it’s important to pay for those operating costs from a separate account so you can more easily understand what your costs look like. Not only will this help improve your financial reporting, it will also give you more clarity over increasing and decreasing operating costs on a more granular level.

Logistics businesses like trucking typically have fairly significant operating costs. The cost of operating a truck surpassed $2 per mile for the first time in recent years. Fuel costs alone were a huge part of that increase in operating expenses for transportation.

Paying those operating costs is unavoidable. You’ll want as much visibility into outgoing cash as possible. Creating a separate cash account for operating costs that are distinct from your accounts receivable bucket will make accounting for this much easier.

Cash Reserves: How Much Cash on Hand Do Trucking Companies Need?

This topic is so dense, we could write a book about it. However, in this post, we’re going to focus specifically on cash. “Cash is king” still applies, but there’s more to it than that. Business survival isn’t just a matter of generating more cash. You could be generating an incredibly large amount of profits and still go out of business if you’re burning through your cash blindly.

Companies that don’t properly manage their cash could still crash and burn in surprising ways.

A common rule-of-thumb for trucking companies is to have “2 months’ worth of expenses.” That sounds good until you realize that it’s not entirely easy to calculate “2 months worth” since that’s a number that can change.

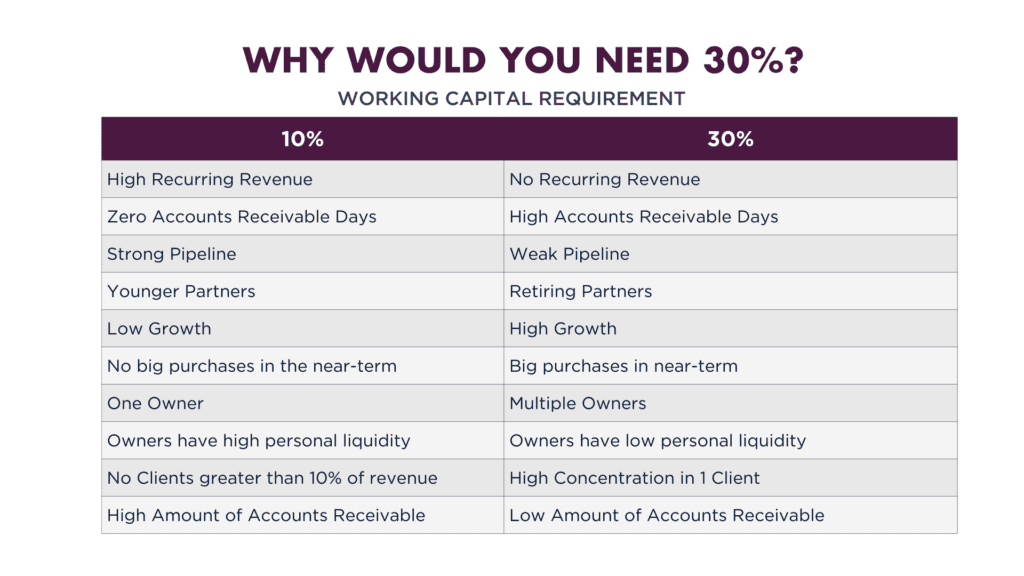

Instead, your cash on hand should be 10% to 30% of your net income. For many trucking or other transportation companies, 10% is about 2 months’ worth of expenses. However, there are good reasons why you may need much more than that.

For example, if your business has…

- High recurring revenue

- A strong pipeline

- Zero or low Accounts Receivable (AR) days

- A strong mixture of clients

- No single client that accounts for more than 10% of your revenue

…then you can likely get by with just 10% in cash on hand.

However, if the opposite of all of those is true (e.g., low recurring revenue, a single client accounting for much or your revenue, and high AR days), you need to increase your cash on hand to upwards of 30%.

You can calculate how much cash on hand you need pretty easily as long as you have your financial data in your spreadsheets or business accounting software.

Let’s say your business earns $12,000,000 in annual revenue. Keeping 10% cash on hand would be $12,000,000 x 10% = $1,200,000. To get that to a monthly figure, just divide by 12: $1,200,000 / 12 = $100,000. If you’re trying to keep to the “2 months” rule, you’d need $200,000 cash on hand.

Keeping 30% would just be 3X that amount ($300,000 per month or $600,000 for 2 months of expenses).

This can seem like a lot of cash on hand. It’s not a reserve you’re going to create overnight, but if you’re adding to this amount over time, you’ll get there.

Tax Reserves: How Much Do I Need to Put Away for Uncle Sam?

Nobody enjoys paying taxes, but if you want your business to be not a business quickly, see what happens when you underpay on your taxes. Tax penalties for underpayment can get expensive. The IRS charges between 5% to 25% on the underpaid amount, and with interest accruing for taking too long to pay those penalties.

Some things to keep in mind about taxes:

- Your business should be paying quarterly estimated taxes

- Failure to pay quarterly estimated taxes will result in penalties

- Underpayment on your quarterly estimate taxes can result in penalties

A separate cash account for taxes can also help you avoid shocks to your business by writing huge checks (and added penalties) when the Spring tax season comes.

That, of course, assumes that you’re properly planning for the taxes you owe on a quarterly and annual basis.

Your tax reserve should be 40% of your company’s net income before taxes. Ultimately, you may end up paying less than that, but it’s better to have more than less at tax time.

Here’s a scenario to illustrate this:

Let’s say your business sets aside $50K per month for quarterly estimated taxes and pays that amount each quarter.

- Q1: Your net income was earned $150,000 ($60k tax bill at 40% with a $10K underpayment)

- Q2: Your net income was $100,000 ($40K tax bill at 40% with a $10K overpayment)

- Q3: Your net income was $200,000 ($80K tax bill at 40% with a $30K underpayment)

- Q4: Your net income was $150,000 ($60K tax bill at 40% with a $10K underpayment)

At the end of the year, your total tax bill would have been $240K. But, because you’ve been paying $50K per quarter on your estimated taxes, you only owe $40K come April 15. And, you don’t have to pay penalties.

Your estimated taxes are based on your previous years’ income statements, divided by 4. Even if your business is brand new with no previous income history, you still need to pay those estimated quarterly taxes to avoid potential penalties.

This is where forecasting comes in, and why hiring tax preparation services is important, especially for businesses in this industry. The cost of services is typically far less than the cost of tax penalties. And that doesn’t take into account the peace of mind that comes with understanding your books and being far better prepared to respond to potential business disruptions.

After all, forecasting and understanding your cash flow benefits your business beyond just taxes. It’s a decision-making strategy that results in a stronger balance sheet at the end of the day as you learn how to optimize your business in a predictive instead of reactive manner.

Line of Credit: Cash When You Need It Most

A line of credit can feel like a loan, and this can make some trucking businesses nervous to open one. However, your ideal situation is to never have to use your line of credit at all. Instead, a line of credit is there for major emergencies and significant disruptions to your cash flow that will help your business stay afloat until your cash flow improves.

Your business should have lines of credit (LOCs) that cover 80% of your receivable balance. That 80% excludes your bad receivables.

Banks won’t extend you a line of credit unless your accounts receivable is clean. If your books are messy, you may need to hire a CPA to help you get your books in order first. Banks will examine your accounts receivable to make sure two big things are true:

- That the amount you want in your LOC makes sense with how much income your business is earning

- That you’ll be able to pay off your LOC if you use it

Neither of those will be visible if your accounting standards are substandard, so you’ll need to spend some time improving your accounting system and cleaning your books before you go in and request that line of credit.

Effective Accounting Creates Sustainable Transportation Businesses

Surviving in the transportation industry as a small business owner or owner-operator has never been more challenging than it is today. Higher operating costs and slimmer margins have made life difficult for everyone. However, with a better approach to cash management, trucking companies and independent operators significantly increase their ability to survive these ups and downs in the industry.

If you have any questions about cash accounts for your transportation business, check out our virtual CFO services for transportation and logistics companies or schedule a consultation below.