The Association of Certified Fraud Examiners held its annual conference last week in Seattle where it presented awards to people who uncovered corruption and financial fraud around the world.

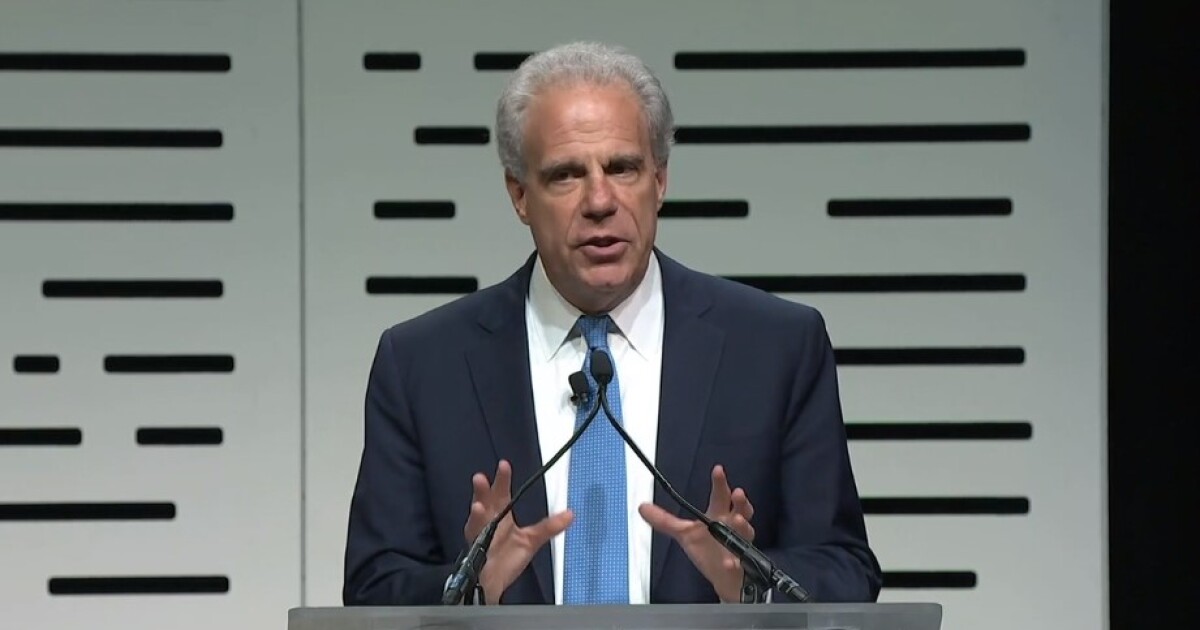

The Cressey award went to Michael Horowitz, inspector general at the Department of Justice, who has led the Pandemic Response Accountability Committee and reported to Congress on the billions of dollars of COVID-19 aid claimed by fraudsters who exploited the Paycheck Protection Program, Economic Injury Disaster Loans and expanded unemployment benefits.

The award is named in honor of anti-fraud expert Donald R. Cressey, a founding father of the ACFE, recognizing lifetime achievement in the detection and deterrence of fraud.

“Receiving the Cressey award is really a tremendous honor given how Dr. Cressey led the field in working with Dr. [Joseph] Wells, who developed and created this organization at a time when corporate compliance and anti-fraud initiatives were really just taking off,” said Horowitz.

Xavier Justo, a whistleblower in the 1MDB scandal, received the ACFE’s Sentinel Award, which is given to a person who has publicly disclosed wrongdoing in business or government, without regard to personal or professional consequences. Justo is a former Swiss banker who helped expose the Malaysian 1MDB scam, one of the largest financial frauds in history.

“As a form of whistleblower retaliation and intimidation, Justo was coerced into a false confession and imprisoned for 18 months before authorities were able to secure his release,” said Ross Pry, vice president of membership at the ACFE, in a video. “He continues to speak out for whistleblower protections and for justice to be served in the case.”

“It’s a great honor and a great privilege for me and my family to receive this award,” said Justo in a video. “It’s justification for all the suffering that we have gone through all these years. And knowing that my son one day will realize that I received this award, it’s an intense moment of emotion for me. As a recipient of this award, I’m proud to have been part of the effort to create a culture of integrity. We must work to build a system of transparency and accountability. This is one of the ways to fight financial crime.

“When I started my career in Switzerland in the ’80s, it was like the Wild Wild West,” he added. “There were no almost no regulations. Today, we have zillions of rules and regulations, but the main problem always is how to implement them. Having these rules and not applying them is like having tons of books and not reading them. It’s completely useless. And today is a great moment in human history: an organization fighting financial crime is giving an award to a former Swiss banker. It’s like giving the title of barbecue chef to a vegan.”

Horowitz talked about some of the fraud cases he had dealt with over the years, including the 1MDB case.

“We just finished a trial, my office working with the U.S. Attorney’s Office and the FBI on a 1MDB case that resulted in a conviction you may have seen of the Fugees singer Pras Michel,” said Horowitz. “We got a call one day from one of my agents, saying that we had just received information that a Justice Department lawyer on a Sunday walked into the Chinese Embassy in Washington, D.C., on a Sunday afternoon and met with the Chinese ambassador to the United States. Not a call you get every day. We began the investigation because we oversee all Justice Department personnel who engage in criminal wrongdoing. It’s obviously unusual to have a DOJ employee, let alone a lawyer, walk into the Chinese Embassy and meet with the Chinese ambassador to the United States. Lo and behold it turns out that he had a side business, which was representing Pras Michel and several other individuals who had been hired by JLo and others in the 1MDB case. And so while a different part of the Justice Department was working on the matter Xavier just talked about, we learned that a DOJ lawyer was actually trying to help the folks who had committed this enormous fraud and it ended up that the case went to trial. It resulted in a conviction a few weeks ago.

Another celebrity was involved in the case as well.

“By the way, among the witnesses was Leonardo DiCaprio,” said Horowitz. “You might wonder, how does Leonardo DiCaprio get into this story? He didn’t allow me to call him Leo. I actually never met him, but my agents did. He’s in the case because where did one of the 1MDB money go? It went to finance movies, including ironically enough for this conference, ‘The Wolf of Wall Street.’ So, I think we are two degrees of separation away from Leonardo DiCaprio and ‘The Wolf of Wall Street.’ But it gives you a sense of how enormous the tentacles are of that fraud and just the enormity of the work Xavier has done to help uncover it and lead to where we are today.”

Another recipient of the ACFE awards was Miranda Patrucic, editor-in-chief of the Organized Crime and Corruption Reporting Project, who received the Guardian Award, which is presented to a journalist whose determination, perseverance and commitment to the truth has helped to expose fraudulent activities around the world, as well as shine a spotlight on critical issues that are essential to fraud prevention and detection. She worked on investigations of the Panama Papers, the Paradise Papers, and other reports, spending nearly two decades exposing fraudulent activities at the highest levels around the world.

She reflected back to a story she had done on tobacco smuggling. “They were looking for a reporter in the Balkans to do a profile about Milo Djukanovic, the [former] prime minister and president of Montenegro for more than 30 years,” she recalled in a video. “They asked for a profile, but I started reading what other people were doing. Everybody says he’s so rich, but nobody ever proved how rich he was. So here’s me, a girl from Sarajevo, who doesn’t know anything about Montenegro and never got any kind of records, deciding to go and investigate the prime minister, the most powerful person in the country. So what happened is, I knew he must have some properties, but the only way I could search the property registry was if I knew his like a social insurance number. No way I could know that. So what did I decide to do? I went and spent a month every waking hour of every day for a month basically spent looking through each last plot of land in Montenegro, one by one, street by street, building by building and then one night at 3 a.m. I still remember that. I found my first property that the prime minister owned and I called my editor at 3 a.m. and said, I got it. And he told me you got your miracle. I was able to uncover that the family owns over 100 million in assets.

“After I broke the story. I suddenly became a celebrity in Montenegro,” she added. “Everybody knew about it. And then when I finished that story, it was time to get another miracle. The prime minister had a bank. And at the time the story was published, the bank had to be bailed out because a lot of state funds were used to basically pay loans to his friends and family members and so on. So I wondered what happened. And I kept asking what happened with this bank? I knew that PricewaterhouseCoopers did an audit. I knew there were some other investigations. And I kept asking reporters, do you know what happened? They would tell me to just forget about it. You’ll never get it. Three years later, I walked in, met the person and I said, Do you know what happened? And the person said, Yes. And I got a pile of documents, internal reports from the central bank, investigations into the bank of the prime minister. Of course, I couldn’t leave the country with the piles of documents. So I spent all night scanning page after page after page after page of the reports, and I kept seeing money laundering, opening accounts for drug lords, even paying Madonna when nobody else could withdraw their money. Incredible, incredible story. So I ended up publishing this big investigation. Two days before publication, I learned that both me and my source could go to jail if we filed this, and of course, as soon as it was, the prosecutor opened an investigation, but they never found my source.”

The Certified Fraud Examiner of the Year Award, presented to a CFE who has demonstrated outstanding achievement in the field of fraud examination, went to Hannibal “Mike” Ware, inspector general of the U.S. Small Business Administration, who is responsible for overseeing billions of dollars in funding for the SBA’s programs and operations as well as serving as chair on the Subcommittee on Audits, which works to protect pandemic-related funds in the U.S. “He has been formally recognized by the inspector general community for his integrity and efficiency, and he continues to set an example for CFEs around the world,” said Pry.

The James R. Baker Speaker of the Year Award, which honors an individual who demonstrates the true spirit of leadership for communication, presentation and quality instruction, went to Mary Breslin, founder and president of Verracy, an internal audit training and consulting firm, who is a speaker at ACFE chapter events and the presenter at this year’s 34th annual ACC global fraud conference.

The Educator of the Year Award was presented to Stan Yakof, an adjunct professor of law at Fordham University School of Law, where he teaches trading, risk management and market structure regulation. He is also head of America supervision at Citadel Securities.

The Outstanding Achievement in Community Service Award went to Maheswari Kanniah, group chief regulatory and compliance officer at Kenanga Group in Malaysia. She has helped to increase chapter membership of the Malaysian Association of Certified Fraud Examiners, participates as a mentor in the 30 Percent Women’s Club Mentoring Program, and has enhanced local social enterprises and underprivileged communities through the HumanKind Project.

The Hubbard Award, named in honor of the late ACFE regent emeritus, Dr. Thomas Hubbard, recognizes the best feature article in Fraud Magazine, as decided by the members of the ACFE Editorial Advisory Committee. This year’s article, Fraud and the North Korean cyberthreat, highlighted state-sponsored cyber fraudsters in North Korea, and what fraud examiners can learn from this emerging threat. The article’s author, Patrick Westerhaus, is a CFE and CEO of Cyber Team Six.

The ACFE Chapter Awards went to the New York Chapter and Southwest Ohio Chapter as Chapters of the Year, and to the South Florida Chapter as this year’s recipient of the first-ever Chapter Community Outreach and Service Award.