If you’re like many business owners, you know that you have to handle certain tasks, like purchasing items, taking on debt, or putting your own money into your business, to get your venture up and running. And when your company processes any type of transaction, whether it’s debt, purchases, etc., you have to record it in your books. This is where accounting assets vs. liabilities come into play. To get a solid understanding of the difference between assets vs. liabilities, keep reading.

Assets vs. liabilities: The differences

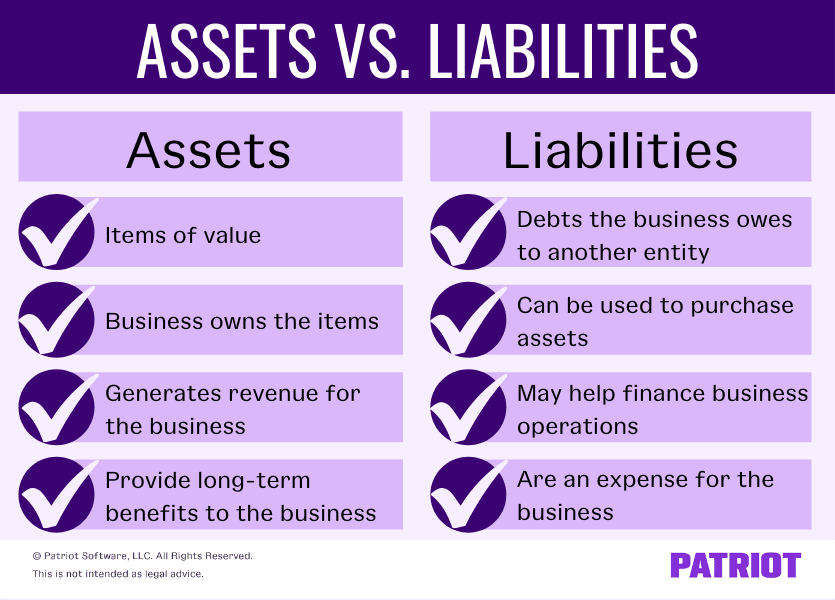

What is the difference between assets vs. liabilities? To understand how the two differ, you have to know the liability vs. asset meaning:

- Liabilities: Existing debts a business owes to another business, vendor, employee, organization, lender, or government agency. Liabilities can help owners finance their companies (e.g., loans).

- Assets: Items or resources of value that the business owns. Assets can generate revenue and provide long-term benefits to the owner (e.g., property).

Both assets and liabilities are on the balance sheet, which is one of the three main financial statements for businesses.

Examples of liabilities

Liabilities can be short- or long-term. Typically, short-term liabilities are known as current liabilities. And, long-term liabilities are called noncurrent liabilities.

Examples of current liabilities include:

- Short-term debts (e.g., credit card balances)

- Tax liabilities (e.g., payroll taxes)

- Accrued expenses (e.g., received goods you purchased but have not received an invoice yet)

- Accounts payable (i.e., unpaid invoices)

Here are a few examples of noncurrent liabilities:

- Loans lasting more than a year (e.g., mortgage loans)

- Deferred tax payments

- Other noncurrent liabilities (e.g., leases)

You must pay short-term liabilities within one year of incurring the debt. Long-term liabilities include debts you pay over a period that is longer than a year.

Examples of assets

Like liabilities, businesses can have current and fixed assets (aka noncurrent assets). A current asset is a short-term asset, while noncurrent assets are long-term.

Examples of current assets include:

Current assets can be converted into cash quickly, typically under one year. Another common term for current assets is short-term investments.

Examples of noncurrent assets include:

- Property (e.g., buildings or cars)

- Equipment

- Patents or trademarks

Noncurrent assets are also known as fixed assets. They provide long-term, continual value to a business. But, businesses cannot convert fixed assets into cash within one year. Long-term assets typically depreciate in value over time (e.g., company cars).

Assets can also be tangible or intangible. Tangible assets are physical items that the business owns. These types of assets easily convert to cash. Physical assets include items such as inventory, equipment, and bonds.

Intangible assets are nonphysical items that do not easily convert to cash. Examples of intangible assets include logos, trademarks, patents, and business licenses.

Assets and liabilities examples

There is some overlap between assets and liabilities because you can use a liability to purchase an asset. To fully understand the difference between assets and liabilities, take a look at some asset vs. liability examples.

Example 1

Your business grows and you weigh the pros and cons of leasing vs. buying commercial property. After examining your books, you decide to purchase property.

The property you purchase is a long-term asset that you can grow in value over the years you own it. The cost of the property is spread out over time instead of one year.

On the other hand, the mortgage for the property is a liability in your books. The mortgage loan is a long-term debt you owe to a lender.

Example 2

Say you decide to lease a car for your employees to use on official business. Is the car an asset? No. The car is not your property because it is not a purchase.

Instead, a leased vehicle is a liability for the business even though the business has temporary possession of the car. Payments for the lease increase expenses for the business but do not provide an item of value to the business’s bookkeeping.

Example 3

Let’s say you decide to purchase the leased vehicle when the lease term is up. You need to take out an auto loan to finance the purchase of the car.

When you purchase the vehicle, it becomes an asset you record on your balance sheet. And, the auto loan is a new liability you record, too.

Why is the auto loan a new liability? When the lease term is done, the liability is complete because you paid the entirety of the lease. Signing an auto loan creates a new debt for the business.

Example 4

Say you choose to use funds from your business to purchase the leased vehicle at the end of the lease term. By using your business funds, you do not have to take out an auto loan.

The vehicle becomes an asset at the time of purchase. Because there is no loan, you do not incur a liability. Instead, the purchase is an expense.

Assets vs. liabilities vs. equity

Now that you know the difference between assets vs. liabilities, it’s time to understand the role of equity in the accounting equation. Equity is the:

- Amount the business owner or stockholders invest in the company

- Value of the company

Equity is a crucial part of the business’s relationship between assets and liabilities.

On a balance sheet, assets equal the total liabilities plus the total equity. If they don’t balance, you need to find and fix the discrepancy. There are several ways to look at the equation:

Equity = Assets – Liabilities

Assets = Liabilities + Equity

Liabilities = Assets – Equity

The accounting equation shows business owners and their financial advisors if the business uses its own funds or finances through debt. Only companies that use double-entry bookkeeping should use the accounting equation.

Equity has an equal effect on both sides of the equation. If a business has only two parts to the equation (e.g., equity and assets), it can calculate the third amount with ease.

This article has been updated from its original publication date of March 22, 2022.

This is not intended as legal advice; for more information, please click here.