Although many Coronavirus Aid, Relief and Economic Security (CARES) Act programs have come to an end, they continue to have an enormous impact on businesses. With the SBA and IRS continuing to release announcements and clarifications around relief programs, we’re breaking down important updates to explain what they mean to your business. See the latest clarifications below.

8/15/2023: IRS Clarifies ERTC Ineligibility due to Supply Chain Disruptions

Throughout 2020 and 2021, supply chain chaos caused major disruptions to businesses, sometimes to the extent that some had to fully or partially suspend their trade or business. Some employers may have heard rumors that a COVID-19 outbreak was responsible for delays or stops in deliveries or bottlenecks at port. As supply chain disruptions impacted ports around the world, critical goods were either delayed or lost entirely, some companies that weren’t shuttered by a government authority still had to temporarily suspend operations as a result.

Since one way to qualify for some CARES Act programs, such as the Employee Retention Tax Credit (ERTC), is for an employer to show evidence their operations were partially or fully suspended by a governmental authority due to COVID-19, do supply chain interruptions during parts of 2020 and 2021 entitle an employer to qualify for the ERTC or other CARES Act programs?

Unfortunately, no. According to recent guidance from IRS memorandum AM 2023-005, language in the CARES Act does not include supply chain disruptions because the disruption, by itself, doesn’t “rise to the level of a full or partial suspension primarily because no governmental order applies to the employer’s operation.”

There is an exception, with very limited, narrow scope, for employers who had to fully or partially suspend business operations because their suppliers were ordered to by an appropriate governmental authority.

The limited exception allows that “[a]n employer may be considered to have a full or partial suspension of operations due to a governmental order if, under the facts and circumstances, the business’s suppliers are unable to make deliveries of critical goods or materials due to a governmental order that causes the supplier to suspend its operations.”

To qualify for the exception, the employer must provide documentation or records demonstrating the following:

- The supplier had to suspend operations due to a governmental order

- The employer’s business had to partially or fully suspend operations because of the supplier’s inability to deliver goods or materials

- An alternative supplier was unable to deliver the critical goods or materials

5/19/2023: EIDL Borrowers Should Prepare for SBA Financial Reporting Requests

Early recipients of EIDL funds will receive a request from the SBA this year for financial information, per their EIDL agreement. A typical deadline would have been March 31, 2023 but as that has already passed, it’s likely that requests will be delayed and sent by December 31, 2023. Borrowers will then have 90 days to submit the requested information, possibly by March 31, 2024.

In the EIDL agreement, under the section titled “Books and Records,” there is a list of information that fund recipients may be required to share with the SBA. The section also includes guidance on record-keeping best practices. According to the agreement, borrowers are required to maintain “current and proper books of account in a manner satisfactory to SBA for the most recent five years until three years after the date of maturity, including extensions, or the date this Loan is paid in full, whichever occurs first.”

These books will need to include the following:

- Financial and operating statements

- Insurance policies

- Tax returns and related filings

- Records of earnings distributed and dividends paid

- Records of compensation to officers, directors, members, partners, proprietors and holders of 10% or more of your capital stock

As part of the conditions of the EIDL agreement, borrowers authorized the SBA to inspect and audit any books, records or other items relating to the borrower’s financial or business conditions. The SBA may also perform inspections and appraisals of any of the borrower’s assets. Furthermore, you may receive a request in writing from the SBA for an Accountant’s Review Report to accompany the financial statements. This review must be prepared by an independent public accountant and be paid for by the borrower.

The SBA may not require all the information listed above, but it’s wise to take advantage of the apparent delays to ensure your organization is prepared to comply with the eventual requests for information. In the case that the SBA decides to audit your business, it will be critical to have well-organized financial documentation.

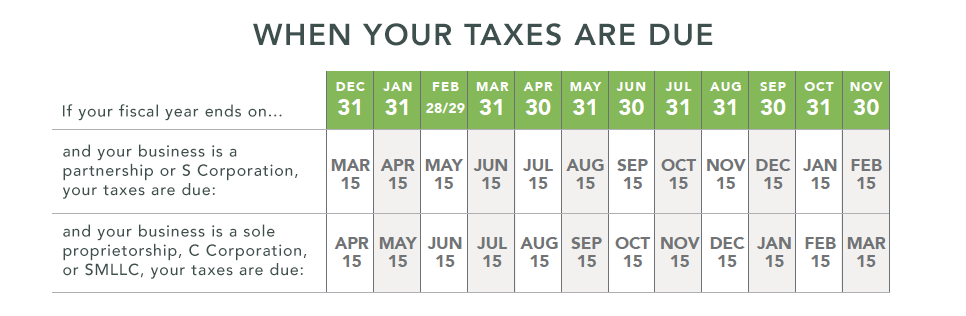

5/4/2023: Final ERTC Filing Deadlines for 2020 and 2021 Confirmed

Upcoming deadlines for the Employee Retention Tax Credit (ERTC) have been confirmed. The pandemic-era credit is still available to eligible businesses retroactively if they file IRS Form 941-X. The form is used to make corrections to the original Form 941s filed by the business, but businesses are limited in how long they have to correct these filings.

Guidance from the IRS regarding Form 941-X deadlines reads, “Generally, you may correct overreported taxes on a previously filed Form 941 if you file Form 941-X within 3 years of the date Form 941 was filed or 2 years from the date you paid the tax reported on Form 941, whichever is later.” Forms 941-X must be filed no later than April 15 each year, which means the upcoming ERTC filing deadlines are as follows:

- Eligible employers must submit ERTC claims via their 941-X for Q2, Q3 or Q4 of 2020 by April 15, 2024

- Eligible employers must submit ERTC claims via their 941-X for Q1, Q2 or Q3 of 2021 by April 15, 2025

4/20/2023: IRS Adds Aggressive ERTC Promoters to 2023 Dirty Dozen Tax Scam List

To encourage businesses to exercise caution around third-party Employee Retention Tax Credit (ERTC) promoters, the IRS has added a new entry to the 2023 Dirty Dozen list of tax scams. This annual list identifies scams and schemes for taxpayers to avoid. Last year, the IRS identified aggressive, third-party ERTC promoters pushing businesses to apply for the pandemic credit even when the business is not eligible for the credit.

IRS Commissioner Danny Werfel said in a statement, “Businesses need to think twice before filing a claim for these credits,” adding that while there are promoters “misleading” businesses into believing they are eligible for ERTC funds, there are “very specific guidelines around these pandemic-era credits; they are not available to just anyone. People should remember the IRS is actively auditing and conducting criminal investigations related to these false claims.”

The Commissioner urged businesses to remain wary of direct solicitation and advertisements promising tax savings that seem too good to be true. Instead, businesses are encouraged to seek advice from their trusted tax professional on the matter since the consequences of improperly claiming the credit can result in having to repay the credit along with additional penalties and interest.

There are many ways these third-party ERTC promoters attempt to pressure honest taxpayers and businesses to apply for the credit. Some may not fully or accurately explain eligibility and computation requirements of the credit. Oftentimes, they may use broad arguments to suggest that all employers are eligible, but fail to evaluate an employer’s individual circumstances. Some did not tell employers that they could not claim the ERTC on wages reported as payroll costs while obtaining Paycheck Protection Program (PPP) loan forgiveness.

Taxpayers and businesses should understand that anyone who files an ERTC claim are the ones ultimately responsible for the accuracy of the information on their tax return. As a reminder, to be eligible to claim the ERTC on qualified wages paid between March 12, 2020 and December 31, 2021, employers must have:

- Orders from an appropriate governmental authority that suspended, either fully or partially, operations and led to limited commerce, travel or group meetings due to COVID-19 in 2020 or the first three quarters of 2021; and

- Undergone a significant decline in gross receipts during 2020 overall or a decline in gross receipts during the first three quarters of 2021; or

- Qualified as a recovery startup business for the third or fourth quarters of 2021

4/5/2023: SBA Offers Hardship Accommodation Plan for Struggling EIDL Borrowers

The COVID-19 pandemic is still causing widespread, adverse effects, leading the SBA to provide EIDL borrowers who are continuing to struggle with a Hardship Accommodation Plan. The plan gives borrowers still struggling a bit of temporary relief, but there are several requirements and potential effects that must be noted before applying.

Under the Hardship Accommodation Plan, eligible borrowers experiencing short-term financial challenges will be able to make reduced payments for six months. Interest will continue to accrue during that time, potentially creating or increasing a balloon payment at the end of the loan term.

Beginning 60 calendar days before the date their first payment is due, Borrowers are eligible to enroll in the Hardship Accommodation Plan. For loan amounts less than or equal to $200,000, you should create a Capital Access Financial System (CAFS) account or log into your existing account. Once logged in, hover your cursor over “Borrower” and select “Borrower Search.” Choose the appropriate loan number and on the Loan Info page, you can request Hardship Accommodation.

To apply for Hardship Accommodation on loan amounts that exceed $200,000, you will need to contact the COVID-19 EIDL Servicing Center at (833) 853-5638 or disastercustomerservice@sba.gov and include “Hardship Accommodation Plan” in the subject line. Overall, the terms of the hardship plan are as follows:

- Borrowers must pay at least 10% of their monthly payment amount (a minimum of $25) for six months

- Larger payments can be made voluntarily during the Hardship Accommodation period

- Regular monthly payments will resume once the six-month Hardship Accommodation period ends

- Borrowers can renew the Hardship Accommodation Plan if needed

Making use of the SBA EIDL Hardship Accommodation Plan can grant struggling businesses a temporary reprieve from loan payments, allowing them to catch their breath and devise a strategy to power them through a rough spot.

2/10/2023: Terminating SBA Liens on Fully Repaid EIDL Funds

Businesses who received an Economic Injury and Disaster Loan (EIDL) from the SBA must manage their own lien termination. The SBA placed Uniform Commercial Code (UCC) liens on assets belonging to businesses who received $25,000 or more in EIDL funds. Once the EIDL funds are paid back, borrowers should receive a letter in the mail from the SBA noting that the loan amount has been fully repaid.

When borrowing from a bank, the bank may also put a lien against the borrower’s assets but unlike the SBA, the bank will remove the lien itself. Because the SBA is not a banking institution, it is not responsible for terminating the lien: you are. To determine whether there is an active lien against your business assets, visit your state’s Secretary of State website to search for your business. It’s also where you can have the lien terminated.

The process of terminating an SBA lien is complicated, especially since most businesses have no experience with the process as it’s typically handled by their bank. Complicated as the process might be, it’s an essential one. The lien must be satisfied prior to receiving any additional loans that use business assets as collateral.

Failure to do so will impact your ability to move your business forward.

2/2/2023: SBA Focuses on PPP and EIDL Audits in 2023

The Small Business Administration (SBA) has begun auditing recipients of the Paycheck Protection Program (PPP) and Economic Injury and Disaster Loan (EIDL) funds, which may make some business owners nervous about their fate. The good news is that businesses who qualified for the programs and adhered to the conditions associated with the program need not worry.

The SBA and other enforcement agencies like the IRS are less interested in pursuing honest businesses and instead focused on going after criminals who knowingly defrauded the programs. As long as you provided accurate information and spent the funds on approved expenses, the process should be virtually pain-free.

That being said, the old adage, “ignorance of the law is no excuse” still applies. It can result in consequences, including being found ineligible for their loan, loan amount or ineligible for the amount of loan forgiveness that had been claimed, forcing you to repay the outstanding balance of the loan. If you’re contacted by the SBA, you need to reach out to your advisors to help you through the process.

In the case of the EIDL program, the funds released to borrowers were meant to keep their business afloat, allowing them to pay employees and working capital, but specifically forbid them to use the funds for other items spelled out in the loan agreement. If you own a restaurant, for instance, and used your EIDL funds to purchase a second location, that would fall short of the eligible uses of proceeds.

For both CARES Act loan programs, the SBA will focus on business eligibility, the loan amount and use, and for PPP there will a determination whether the borrower is eligible for forgiveness on the claimed amount. Businesses may need to provide the following documentation to the SBA during an audit:

- Payroll records

- Bank statements

- Proof of expenses such as invoices, receipts or voided checks

- Past accounting records

Gather the documentation ahead of time, consult with financial professionals and take the process seriously. If an innocent mistake was made, engage your advisors when presenting your case to the government agencies. In most instances, a resolution can be reached.

12/22/22: Pandemic EIDL Recipients May Require SBA Subordination Before Applying for New Loans

Businesses seeking to expand or purchase new equipment may face a new hurdle if they received an Economic Injury Disaster Loan (EIDL). Before COVID-19, the EIDL program was more commonly used for natural disasters such as floods, tornados and hurricanes, with the distributed loans averaging around $30,000 to $50,000 or less. With the onset of COVID, the program was expanded, and loan amounts could range between half a million to upwards of $2 million.

While many of the businesses that took part in the first round of EIDL fund disbursements have already begun the repayment process, seeking conventional loans from the bank could be a complicated process.

While many of the businesses that took part in the first round of EIDL fund disbursements have already begun the repayment process, seeking conventional loans from their bank could be a little more cumbersome than before. If a business that received EIDL funding attempts to obtain a loan in a more conventional way, like from a bank, the bank could reject the loan on the basis that the EIDL repayments are the priority. Unless a business receives a subordination from the Small Business Administration (SBA) for their EIDL funds, any other conventional loans they receive will come in second place in terms of repayment priorities.

To subordinate those EIDL funds and free up your business for more traditional forms of borrowing, contact the SBA and complete a subordination request form. The process to subordinate loans may be lengthier than in previous years due to the volume of borrowers and the much higher dollar amounts that were distributed. Forward planning and careful consideration are key in the pursuit of growth in the coming year.

12/12/22: SBA Extends Storm-Related EIDL Payments, Not Pandemic EIDL Payments

Some recipients of pandemic era Economic Injury Disaster Loans (EIDL) may have been confused by a message from the Small Business Administration (SBA) extending payments on those loans by another 12 months. It should be noted that this announcement pertained specifically to loans made on or after September 9, 2022. These loans were related to recent storm and hurricane events rather than loans associated with the pandemic. Because destructive storms and pandemics can be considered disasters, they both qualify as EIDL events.

The pandemic related EIDL program ended on May 6, 2022 and many of the early EIDL recipients have already begun the repayment process and should continue to make those payments to remain in good standing. Later recipients of EIDL funds are still on a deferral and should follow SBA EIDL guidelines to determine when their repayment process begins.

As more information is released concerning CARES Act programs and other COVID-19 pandemic related relief funding, Anders will continue to provide updates to this post to empower business owners and leaders to know exactly where you stand in your CARES Act journey. Contact an Anders advisor below to learn more about the programs designed to help businesses thrive in a post-pandemic world.

10/19/22: IRS Warns of Third Parties Promoting Improper Employee Retention Credit Claims

The Internal Revenue Service (IRS) issued a warning to employers to beware of third parties urging them to claim Employee Retention Tax Credits (ERTC) when they may not qualify for it. Some of these third parties have taken improper positions related to taxpayer eligibility for and computation of the credit. These third parties commonly charge large upfront fees or fees contingent upon the amount of the refund. They may also not inform taxpayers that wage deductions claimed on the business’ federal income tax return must be reduced by the amount of the credit.

The IRS has encouraged businesses to be wary of advertisements and direct solicitations promising tax savings that seem too good to be true. The IRS also added a reminder that it’s the taxpayer who is ultimately responsible for the information reported on their tax returns, meaning the taxpayer would be required to repay the credit, along with penalties and interest, while the third party keeps their fee and moves on.

Our advisors are closely following legislation changes and will continue to publish insights to keep you informed. Stay tuned for more CARES Act clarifications or learn more about our COVID-19 Business Recovery services. To discuss how we can best assist you and the associated fees, contact Anders below.