Having dominated the quarterly lists of new Securities and Exchange Commission audit engagements for the first half of 2023, Top 100 Firm Cohen & Co. topped the rankings for the whole year by a wide margin.

The Cleveland-based firm grabbed the top spot almost entirely due to its March 2023 acquisition of the Investment Management Group of BBD, a Philadelphia-based provider of audit and tax services for registered and unregistered investment companies, which yielded 54 new clients. Overall, the firm brought on 62 new engagements, and netted 57. (See “

Big Four firm Deloitte brought on the second-largest number of new SEC audits, with 40 new engagements, netting 21. (See “

Meanwhile, Los Angeles-based GreenGrowth CPAs netted the second largest number of new clients, with 34, largely because it acquired portions of two different audit practices: Colorado-based Gries & Associates and Utah’s Pinnacle Accountancy Group.

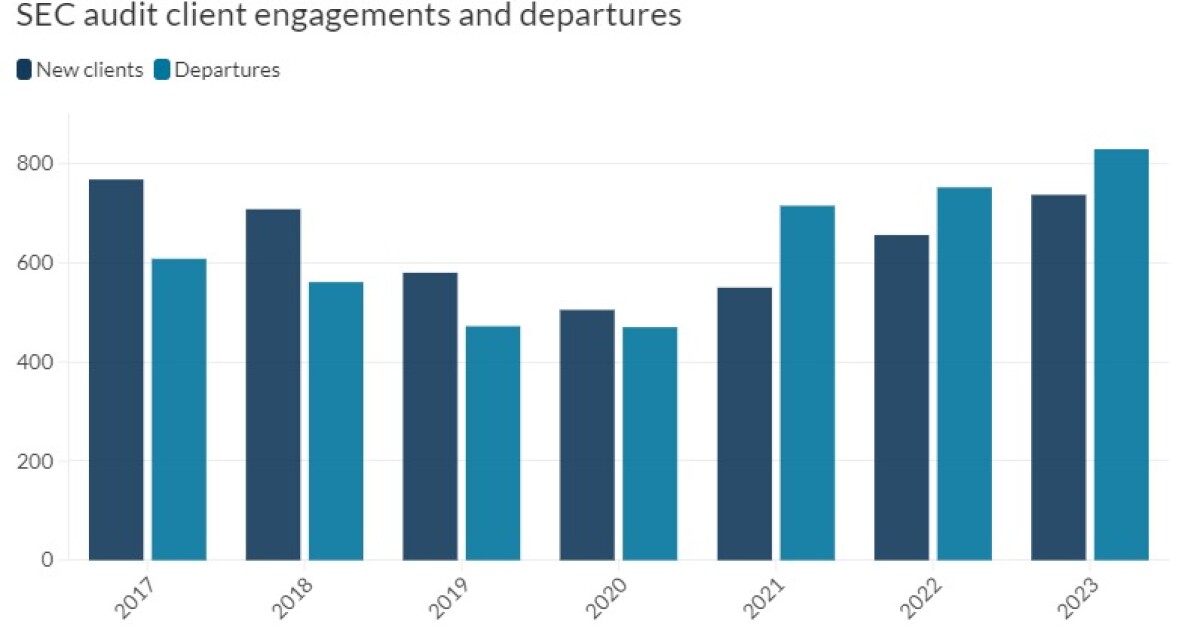

The 737 new engagements signed in 2023 mark a major jump, continuing a rising trend that started in 2021. Client departures, however, also jumped, to 829 from 752 in 2021 — outpacing new client additions for the third year in a row. (The figures don’t match in part because of lags between when a company leaves its previous auditor and when it reports engaging its next audit, but more importantly due to M&A, since an acquired company will be reported as a departure, but will not engage a new auditor.)

The league tables

Deloitte led the tables in terms of new large accelerated filers by a wide margin, and came in a close second to Grant Thornton among new accelerated filers and smaller reporting companies, while GreenGrowth CPAs held a strong lead among non-accelerated filers. (See “

Big Four firm Ernst & Young topped the ranking of new market capitalization audited, thanks to the $53 billion from Corona, California-based energy drink manufacturer Monster Beverage Co. (See “

Cohen & Co. came in first in terms of new assets audited, the overwhelming majority of which — $206.4 billion out of $233.8 billion total — came from ETF developer Select Sector SPDR Trust.

Deloitte came in second in both new market cap and new assets audited, and topped the list of new audit fees. Of its 40 new clients for the year, none stood out in terms of market cap or fees, but Miami-based cruise operator Carnival accounted for almost a quarter of its new assets audited, at $51 billion.

Finally, Grant Thornton took second in new audit fees, with contributions spread relatively evenly across its 26 new clients.

Data for the rankings are provided by Ideagen Audit Analytics, a premium online intelligence service delivering audit, regulatory and disclosure analysis. Reach them at (508) 476-7007,