With economic conditions putting pressure on Australian small businesses, owners are looking at different ways to maintain a healthy cash flow. Our ‘Money matters’ report showed that 61% of Australian small business owners increased their prices in the last 12 months to stay ahead of rising costs and make a profit. 27% also had to dip into their personal savings to manage their cash flow.

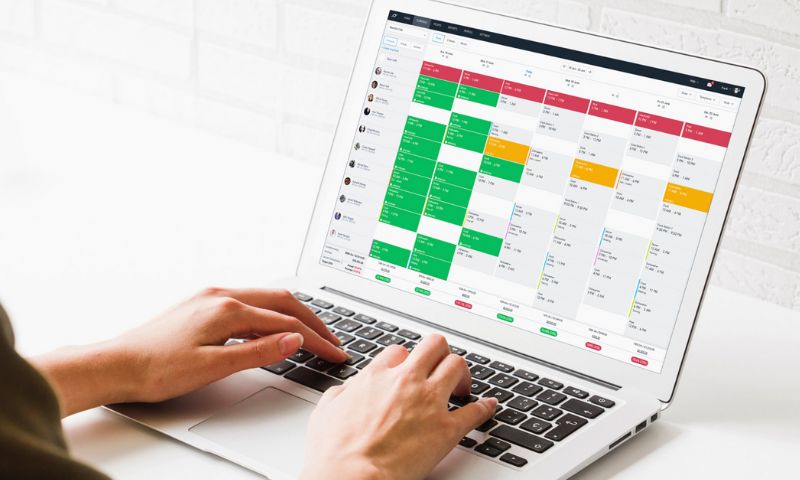

But the digitisation of the administrative jobs for small business owners and their advisors is making it easier than ever to get the right data to make informed choices about how to manage cash flow. This includes employee management tools, such as Planday.

So, what’s considered employee management? Think: building rosters, managing timesheets, setting wages, processing payroll and communicating to your teams. That’s just the tip of the iceberg! Keeping your employees happy means doing these jobs correctly and on time. Manual processes leave room for error which can also affect your balance sheet.

Employee management tools save time and money

When it comes to employee management, manual processes such as pen and paper rostering can take time and can cost you money. Using digital tools can streamline this work and connect into other software creating a simplified experience. This gives you back time to focus on what you do best: running a successful business!

Managers or owners will know that operating a small business means having your trusted team there by your side to keep things running smoothly. But everyone needs a little break now and then, and finding a replacement can be costly without the right insights.

Here are some of the employee tasks you can streamline by using time, attendance and scheduling tools:

- Create rosters, then fill the open shifts

- Deal with leave requests and staff absences

- Manage unplanned staff absences with easy access to other staff availability, all in one place

- Manage team performance with the ability to analyse leave types

Planday allows you to review leave requests based on the employee and their requested leave. It then allows you to find someone to replace shifts based on a similar hourly rate and skillset.

Manage your workforce and cash flow

We know that Australia’s modern award system is one of the most complex, globally. If you’re paying staff in line with an award, your employees must be paid in accordance with the award rates and penalties.

Planday’s built-in award interpretation tool is handy for small businesses because you can import the award rates, and it’ll provide you with a clear understanding of how much you’re spending per employee, per shift. This is a great tool to use when it comes to budgeting salaries against your revenue.

Having the right budgets set up and insights to forecast your revenue and expenses will ease cash flow pressure.

Create a real-time picture of your finances

Using technology to manage your workforce is also great because it can connect with other systems, including your Point of Sale technology. This provides real-time sales forecasts allowing you to roster your teams accordingly, and make sure that not only you have enough people rostered for your busiest days, but you’re also not exceeding your salary budgets.

And when combined with Xero Payroll, Planday is an even more powerful tool giving you a real-time picture of most labour costs versus key operating metrics. It can generate data that business owners or managers can use to make proactive decisions that may influence business growth.

Planday has a great blog which looks at more ways that employee management can improve your cash flow. And if you’re interested in using Planday for your small business or practice clients, log into Xero to sign up and start using it today.