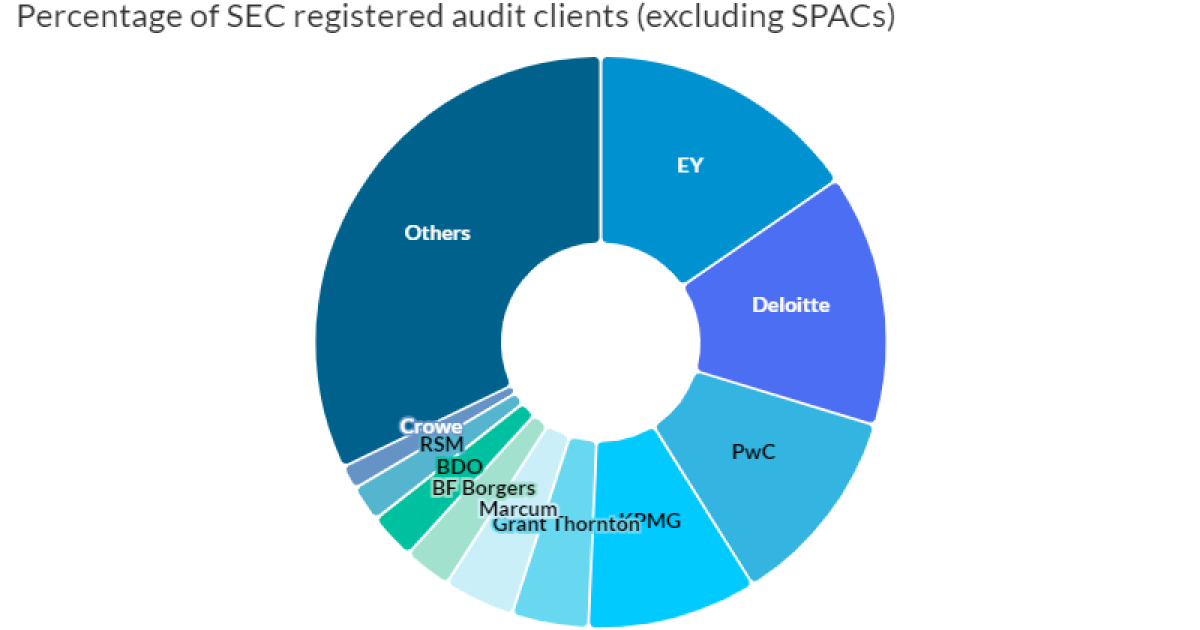

The top accounting firms took another bite of market share for public company audits in 2023.

The 10 firms with the most public company audit clients accounted for 70% of the total market (excluding special-purpose acquisition companies), according to the latest edition of Ideagen Audit Analytics’ annual

While the Big Four held onto their 51% market share from year to year, it was the remaining top 10 firms — Grant Thornton, Marcum, BF Borgers, BDO, RSM, and Crowe — who grabbed the extra share.

This year, there were 6,607 total registrants, down roughly 300 from the previous year. The number of SPAC clients decreased significantly, too. In 2023, 300 SPAC registrants were audited by 16 firms, compared to 707 clients audited by 79 firms in 2022. The decrease in these registrants can be attributed in part to a recent

The effects of the tighter regulation may be reflected in WithumSmith+Brown’s drop from No. 9 to No. 10 on the ranking of top firms by market share including SPACs. In February, the Public Company Accounting Oversight Board hit the Top 25 firm with a

Mid-tier firms saw gains across jurisdiction, U.S. region, and industry. In regards to jurisdiction, midtier firms increased their U.S. share to 20%, up from 14% the prior year. But the extra piece of the pie came from smaller firms rather than the Big Four, who held onto their share.

Mid-tier firms also ate away at smaller firms’ U.S. regional shares, too. The greatest gains were in the Midwest (up eight points) and in the West (up 12 points). Mid-tier firms only took a minimal loss (down one point) in the Southwest.

The same trend can be seen across industries. Mid-tier firms gained ground in construction (up seven points) and finance (up 12 points), among others.

Ideagen’s report includes any registrants who filed a periodic report with the U.S. SEC after Jan. 1, 2023. The auditor market share figures were as of Jan. 30, 2024.