A divided Securities and Exchange Commission voted three to two Wednesday to approve a new rule that would require companies to provide climate-related disclosures to investors, but scaled back the original proposal to exclude disclosure of so-called Scope 3 emissions from their supply chains, and exempt many smaller companies.

The

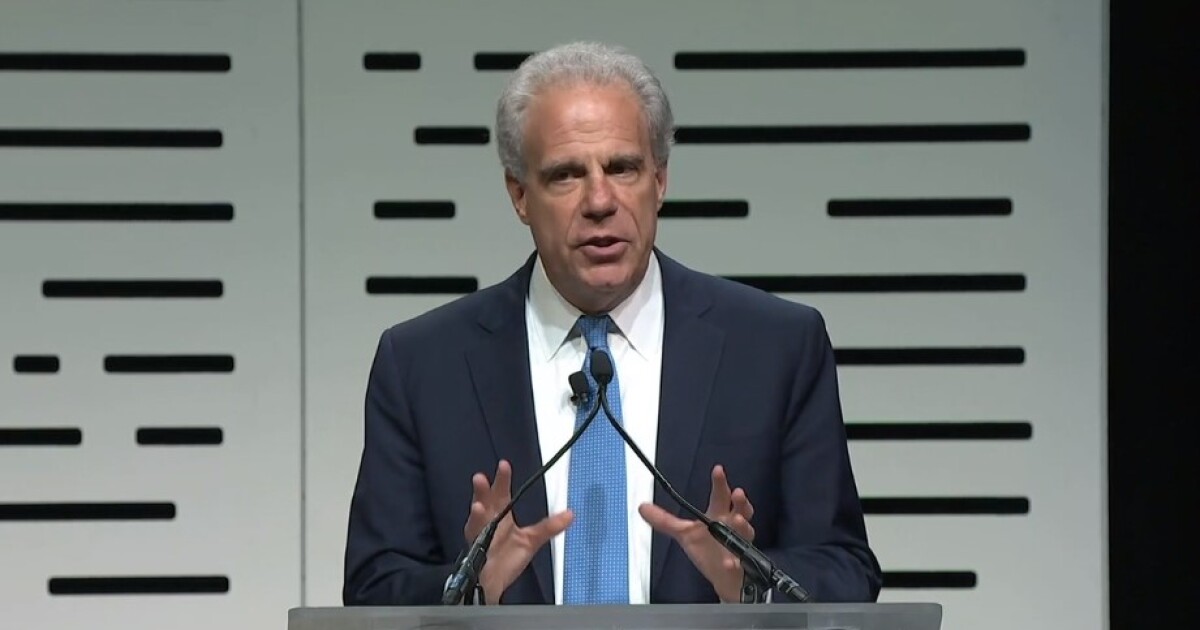

“Today’s rules enhance the consistency, comparability, and reliability of disclosures,” said SEC chair Gary Gensler. “The final rules provide specificity on what must be disclosed, which will produce more useful information than what investors see today. Further, the final rules require that climate risk disclosures be included in a company’s SEC filings, such as annual reports and registration statements. Bringing them into the filings will help make them more reliable. There are standard controls and procedures for filings unlike for sustainability reports.”

The final rules would require SEC registrants to disclose climate-related risks that have had or are reasonably likely to have a material impact on the registrant’s business strategy, results of operations, or financial condition, along with the actual and potential material impacts of any identified climate-related risks on the registrant’s strategy, business model and outlook.

If, as part of its strategy, a company has undertaken activities to mitigate or adapt to a material climate-related risk, it would provide a quantitative and qualitative description of material expenditures incurred and material impacts on financial estimates and assumptions that directly result from such mitigation or adaptation activities.

The rule also includes specified disclosures regarding a registrant’s activities, if any, to mitigate or adapt to a material climate-related risk including the use, if any, of transition plans, scenario analysis, or internal carbon prices. SEC registrants would also need to disclose any oversight by the board of directors of climate-related risks and any role by management in assessing and managing the registrant’s material climate-related risks.

They would also disclose any processes they have for identifying, assessing and managing material climate-related risks and, if the registrant is managing those risks, whether and how any such processes are integrated into the registrant’s overall risk management system or processes.

The rule would require disclosure of information about a registrant’s climate-related targets or goals, if any, that have materially affected or are reasonably likely to materially affect the registrant’s business, results of operations, or financial condition. Those disclosures would include material expenditures and material impacts on financial estimates and assumptions as a direct result of the target or goal or actions taken to make progress toward meeting such target or goal.

For large accelerated filers and accelerated filers that are not otherwise exempted, companies would need to disclose information about material Scope 1 emissions and/or Scope 2 emissions from their supply chain. They would also be required to disclose Scope 1 and/or Scope 2 emissions, an assurance report at the limited assurance level, which, for a large accelerated filer, following an additional transition period, will be at the reasonable assurance level;

Companies would also disclose their capitalized costs, expenditures expensed, charges and losses incurred as a result of severe weather events and other natural conditions, such as hurricanes, tornadoes, flooding, drought, wildfires, extreme temperatures, and sea level rise, subject to applicable one percent and de minimis disclosure thresholds, disclosed in a note to the financial statements;

SEC registrants would disclose the capitalized costs, expenditures expensed and losses related to carbon offsets and renewable energy credits or certificates if they’re used as a material component of a registrant’s plans to achieve its disclosed climate-related targets or goals, disclosed in a note to the financial statements; and

If the estimates and assumptions a registrant uses to produce the financial statements were materially impacted by risks and uncertainties associated with severe weather events and other natural conditions or any disclosed climate-related targets or transition plans, companies would provide a qualitative description of how the development of such estimates and assumptions was impacted, disclosed in a note to the financial statements.

Two of the SEC commissioners objected to the proposal. “The final rule is different from the proposal, but it still promises to spam investors with details about the Commission’s pet topic of the day — climate,” said commissioner Hester Peirce. “As we have heard already, the recommendation before us eliminates the Scope 3 reporting requirements, reworks the financial statement disclosures, and removes some of the other overly granular disclosures. But these changes do not alter the rule’s fundamental flaw — its insistence that climate issues deserve special treatment and disproportionate space in Commission disclosures and managers’ and directors’ brain space. Because the Commission fails to justify that disparate treatment, I dissent.”

Another commissioner, Mark Uyeda, also objected to the rule. “Today’s rule is the culmination of efforts by various interests to hijack and use the federal securities laws for their climate-related goals,” he said. “In doing so, they have created a roadmap for others to abuse the Commission’s disclosure regime to achieve their own political and social goals. First, they purchase shares in public companies under the guise of becoming “investors,” but not with the primary intention of seeking financial return. Rather, they use their holdings as a means to force companies to disclose information related to political and social issues important to them but that may not be relevant to those companies’ business or shareholders generally. After some companies capitulate to their demands, they ask the Commission to adopt rules requiring the disclosure from all companies. Citing such ‘investor demand’ for the information and the need to have “consistent and comparable” disclosure, a politically-oriented Commission might pursue such a rulemaking. If it does, then the result is using disclosure not as a tool to aid investors, but to bypass Congress to achieve political and social change without the corresponding accountability to the electorate.”

However, two of the other commissioners joined Gensler in supporting the rule, giving the Commission a majority to pass it. SEC commissioner Caroline Crenshaw voted in favor of the rule, but added that it didn’t go far enough after it had been scaled back. “Investors made clear to my colleagues and me that these provisions are of key importance,” she said. “Investors need insight into a company’s business, its results, and its financial condition, including material risks it faces. To be crystal clear, though, this is not the rule I would have written. While these are important steps forward, they are the bare minimum. Ultimately today’s rule is better for investors than no rule at all, and that is why it has my vote. But, while it has my vote, it does not have my unencumbered support. And, although I am loath to leave for future Commissions those obligations that I see as our responsibilities today, I’m afraid that is precisely what we are doing.”

She suggested that the SEC should allow companies to use standards from the International Sustainability Standards for their reporting.

“Commenters noted that standard setters for other regulatory bodies, such as the International Sustainability Standards Board (ISSB), are implementing their own climate-risk reporting regimes,” she said. “An order recognizing such a regime would not only respond to investors, but also to the many corporate commenters who favored such an approach. Although we leave it to the future, it would be an easy and meaningful step for the Commission to take in order to avoid a patchwork of reporting obligations and potentially conflicting demands. This idea was overwhelmingly popular in the comment file and mirrors other areas of the securities laws where there are comparable cross-border regimes.”

Back in 2007, the SEC allowed use of International Financial Reporting Standards by foreign companies, and the ISSB climate standard is now overseen by the IFRS Foundation.

Commissioner Jaime Lizárraga also expressed his support. “Investors view this information as relevant to a company’s bottom line and as material to their investment and voting decisions,” he said. “They can also assist with investors’ analysis as to whether hedging or diversifying your portfolio is warranted. The connection between climate-related risks and a company’s fundamental value is well established, as highlighted by studies cited in the Commission’s release. These risks play out for differences in revenues, operating income and expenses, cash flows, capital structures, asset prices, debt performance and investment policies. Investor demand for climate risk disclosures has already had an impact on the market.”

He noted that in the past few years, roughly 60% of Russell 3000 companies and 90% of Russell 1000 companies provide some form of climate-related information and nearly 60% of Russell 1000 companies disclose Scopes 1 and 2 greenhouse gas emissions. “Under the status quo, investors will continue to face a patchwork of disclosures with a limited ability to conduct apples-to-apples comparisons. in the extensive comment process that preceded the proposal and the adoption of this final rule,” he added.

Reactions

Outside observers from some accounting firms agreed. “Regardless of whether it marks a watershed moment or a watered-down rule, companies are now facing a wave of global requirements,” said KPMG U.S. ESG leader Rob Fisher in a statement. “Amidst these disclosure requirements, the organizations that view new reporting requirements as an integral part of their broader strategy will find themselves in a better position to realize the full value sustainability initiatives can bring to their business.”

The SEC rule will provide U.S. companies with an alternative to the patchwork of standards now out there, although like many of those standards it builds on existing frameworks like the one from the Financial Stability Board’s Taskforce on Climate-related Financial Disclosures, which is now overseen by the ISSB, as well as the Greenhouse Gas Protocol.

“The alphabet soup of voluntary climate and sustainability reporting frameworks of several years ago has become the patchwork quilt of climate and sustainability reporting requirements of today,” said KPMG U.S. ESG audit leader Maura Hodge in a statement. “Companies have real work to do to understand their various reporting mandates, while navigating dual challenges of continued policy uncertainty and heightened compliance risks.”

Companies will now have to face requirements from the SEC for reporting. “We’ve entered the next wave of ESG which requires institutional-grade reporting: companies now face compliance risk in what they disclose,” said Anthony DeCandido, ESG and sustainability assurance co-leader with RSM US LLP. “The same rigor required (historically) around financial reporting, now, too, is required for climate reporting. Where the SEC is landing with their guidance will help companies navigate through requirements that are more manageable, sooner. Although many, typically larger, companies have increased their level of reporting of sustainability information in recent years, there remains a broad spectrum of preparedness across the middle market for the coming mandatory era.”