For most of the history of modern accounting, you could count the number of billion-dollar CPA firms on the fingers of one hand — literally.

In fact, the profession started the 21st century with exactly five firms of that size — but it has more than tripled that number in the quarter century since, with most of that increase coming in just the last four years.

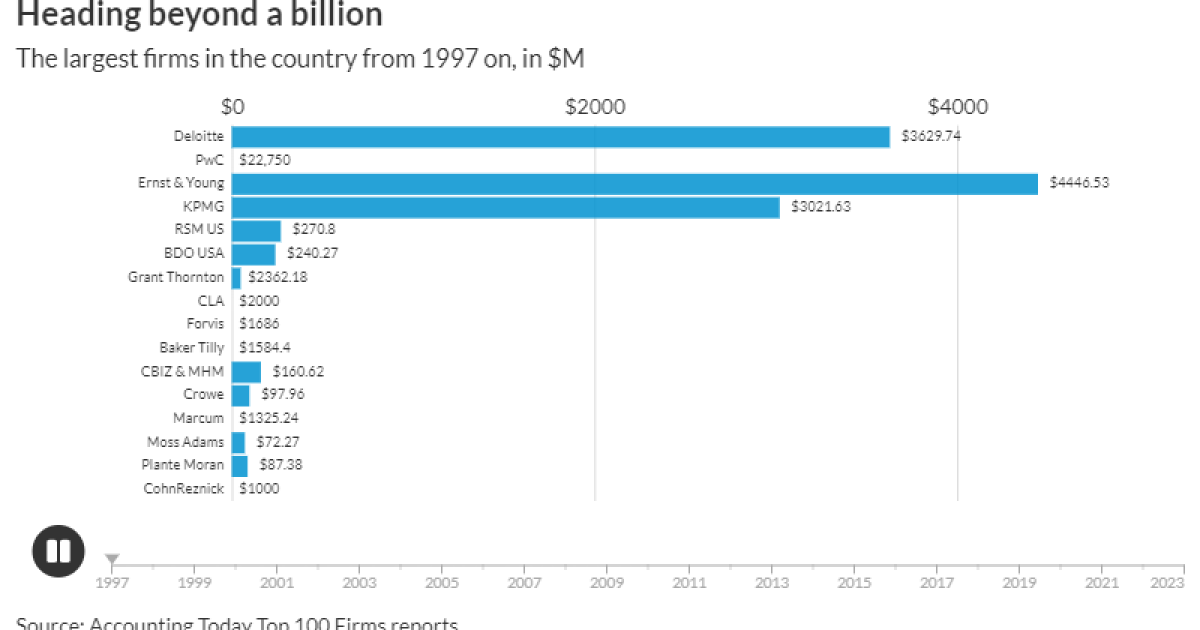

The animated bar chart below shows the growth in this cohort since 1997, with the then-Big Five initially declining to the Big Four after the demise of Andersen in 2002, and then slowly adding four new members (RSM US, Grant Thornton, BDO USA and CLA) in the two decades to 2020.

Between 2020 and now, however, the group has doubled in size, adding eight new members, including two in the past year alone (Plante Moran and CohnReznick). What’s more, there’s a cadre of fast-growing firms below a billion that revenue threshold that look ready to keep expanding the billion-dollar ranks over the next few years. (For more details, see our

While it may be tempting to think of the billion-dollar mark as a purely arbitrary psychological threshold — an artifact of how human beings think about numbers — there are a number of significant differences between them and the vast majority of their smaller peers.

In some ways, the biggest firms are more akin to large corporations than to their smaller kin in public accounting, with management, marketing, HR, IT and other back-office structures that are far more highly developed and professionalized — as they have to be, to support the much larger number of partners, employees and clients involved, across a wider geographies and broader ranges of services.

There are also some very specific ways that these large firms differ from the rest of the Top 100.

For instance, the billion-dollar firms tend to leverage far larger staffing ratios, with staff-to-partner rates that are much higher than the smaller members of the Top 100 Firms. For 2023, the largest 16 firms had 17.8 staff per partner, while the firms with below $1 billion but more than $100 million in revenue average 9.6 staff per partner, and those smaller than $100 million had 8.7 staff per partner.

They are also far more likely to be involved in consulting: In 2023, it accounted for 45.7% of their revenues, versus 21.6% of the revenues for firms between $100 million and $1 billion, and only 14.7% off Top 100 Firms with less than $100 million. And they’re much less interested in tax: Approximately a quarter of their revenues comes from that, versus roughly 37% for the rest of the Top 100.

They have roughly the same interest in audit & attest, though, with all three cohorts of the Top 100 getting around 30% from that area.

And while their revenues are much higher, their growth rates are generally slower: They grew 12.13% in 2023, against 19.8% for those in the tier just below them in our Top 100 ranking, and 13% for those earning less than $100 million.