The Internal Revenue Service is providing a way for businesses to withdraw incorrect claims for the Employee Retention Credit if they haven’t been paid yet, but what about the claims that have been paid out already?

Last week, the IRS announced it would provide a way out for businesses that fell prey to so-called “ERC mills” that have been relentlessly promoting and advertising the pandemic tax break as a way to score easy money (see story). However, one of the conditions for qualifying for the process is that the IRS has not yet paid their claim, or the IRS has paid the claim, but the business hasn’t yet cashed or deposited the refund check. But that leaves millions of other businesses wondering what to do if they’ve already received a refund and deposited it.

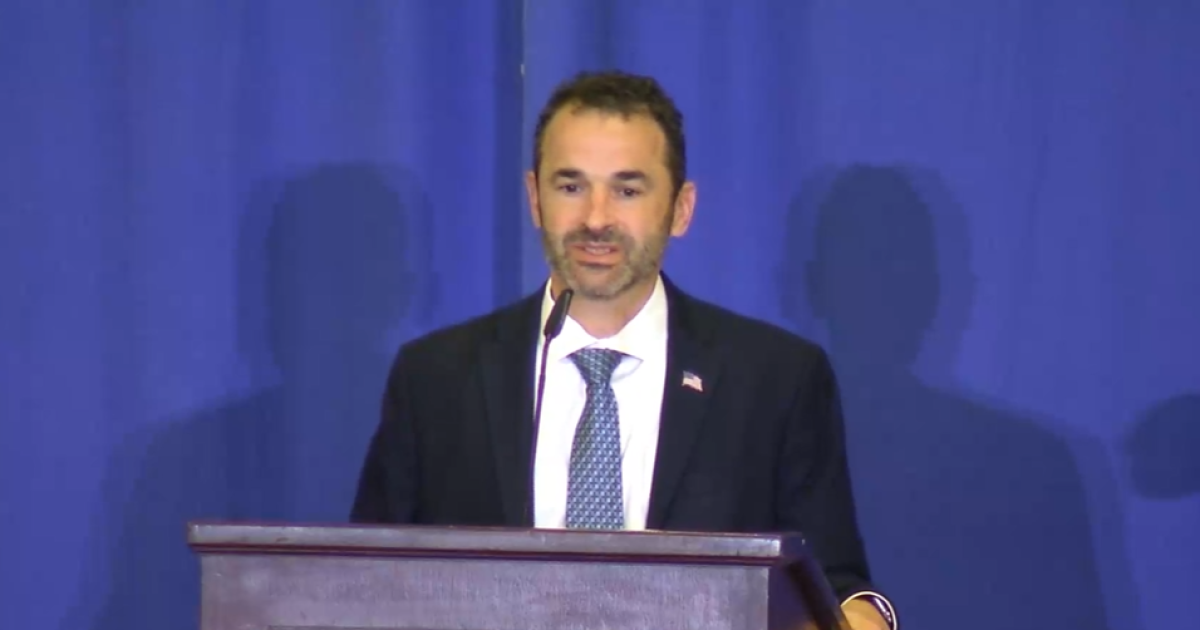

“You’re going to have mistakes, you’re going to have gross negligence, and you’re going to have fraud,” said Eric Hylton, a former commissioner of the IRS’s Small Business/Self-Employed division and deputy chief of the IRS’s Criminal Investigation division who is now national director of compliance at the tax consulting firm Alliantgroup. “Overall, if you have situations in which CPAs want to help file for amnesty, there are a number of different options there in which a company that has filed but the claim has not been processed, or they have not cashed a check, they can withdraw and the IRS has come up with some procedures as it relates to that.”

Andrew Harrer/Bloomberg

Accounting firms have been inundated with clients asking about claiming the ERC and now they’re hearing concerns about potentially being penalized if they claimed the tax credits. The withdrawal process may help alleviate some of those worries.

“This looks like a very easy process for taxpayers that are eligible,” said Devin Tenney, a senior manager with Baker Tilly’s Washington National Tax Office. “It will depend on their situation because there are different means of applying for the withdrawal, depending on their situation, but in all cases, it does look like it will be a fairly painless process. And because of that, I will say there is a sense of urgency with this withdrawal program because it is limited to only those taxpayers that currently have their claims being reviewed, or have received checks and not cashed or deposited them. It is imperative that taxpayers are made aware of this, so they can make an informed decision if they want to use this process now before it may become too late. Once they get that check in hand, it’s hard to not put it in the bank.”

The Employee Retention Credit has some complexities that often need professional help in deciding whether a claim is correct or not, especially when a business has also received a loan from the Paycheck Protection Program, and the ERC mills are often not in a position to provide that kind of expertise. “You have some situations where some of these firms don’t really have the background from a tax or accounting or even financial standpoint, and they haven’t really done due diligence as relates to the complexity of the ERC, taking into account whether there’s the interplay between ERC and the PPP,” said Hylton. “For a larger company, it’s thinking about the aggregation rules, and whether they’re looking at control groups, and recognizing that they would have to look at the wage disallowance for their individual tax return. There are a number of different complexities.”

Some ERC mills are continuing to push the tax credits, despite the IRS’s moves to crack down by imposing a temporary moratorium on processing new ERC claims and providing a withdrawal process (see story).

The IRS’s Criminal Investigation division will be on the lookout for cases of outright fraud. “Think about some of the cases that IRS CI would be really interested in,” said Hylton. “There are situations in which companies are just falsely preparing some of these returns for businesses without their knowledge, or some businesses are falling in the domain where they don’t have the employees or they’re manipulating their gross receipts.”

He noted that the Criminal Investigation unit is already investigating many such cases, especially when it comes to the promoters pushing the ERC claims on business owners. “There’s hundreds of cases that have gone over to Criminal Investigation and thousands have been sent over for audits to really take a closer look at, and some of the ones that are sent over to audit will maybe have some civil fraud associated with that,” said Hylton. “You definitely want to make examples out of some of these popup organizations with little to no knowledge about the ERC and pursue that and publicize that as much as possible.”

Accounting firms have been getting requests from clients for advice about the ERC even as the IRS has been putting more pressure on the ERC mills pushing the tax credits, announcing a temporary moratorium last month on processing of new ERC claims until the end of the year (see story).

“It’s been very interesting seeing over the last year these repeated warnings coming from the IRS, and they’ve apparently had zero impact on these ERC mills,” said Tenney. “The IRS still received a deluge of additional claims, so the moratorium was a surprise to me, but I think it was absolutely needed. And then when they issued the moratorium last month, they mentioned that this program was going to be coming out. I wasn’t sure exactly what that program was going to entail. I was hoping that it may have had a little bit broader coverage, but they have hundreds of thousands of open claims for the ERC currently, and they believe that the vast majority of those claims are improper. This program makes a lot of sense because it’s really two birds with one stone. One, you’re allowing taxpayers to easily back out of this, and two, by providing that opportunity, the IRS has less claims that they have to worry about. I’m sure they are absolutely just overwhelmed with the work that they have to do on this.”

Last month, IRS Commissioner Danny Werfel said the IRS had received approximately 3.6 million ERC claims to date, and its current open inventory of open claims was over 600,000, nearly all of which had been received within the previous 90 days. The withdrawal process is likely to help most of those taxpayers whose claims have been caught in the backlog, but the ones who have had their claims already paid will need to wait for further guidance from the IRS on whether they will face tax penalties and interest.

Werfel noted that the withdrawal option could be used by anyone in the group of 600,000 employers whose claim hasn’t been paid yet to allow businesses to avoid possible repayment issues and so they wouldn’t need to pay promoters contingency fees out of their refunds. The IRS said last week it is working on guidance to help employers that were misled into claiming the ERC and have already received the payment. More details will be available this fall.

“If a business received a payment already, the IRS is building a special settlement program,” Werfel said during last month’s press conference. “This option will allow repayments for those who received an improper ERC payment. We will have more details later in the fall on the settlement initiative.”

In the meantime, the withdrawal process provides a kind of amnesty program to taxpayers whose claims haven’t yet been processed.

“It’s a great start,” said Tenney. “It is limited in this application, but the IRS did mention also in their communication that they will be subsequently coming out with another disclosure program. I don’t have any information on what that program will entail, but I would imagine it’s going to be directed toward those taxpayers that are ineligible for the withdrawal process but still would like some form of ability to unwind the situation they’ve found themselves in.”