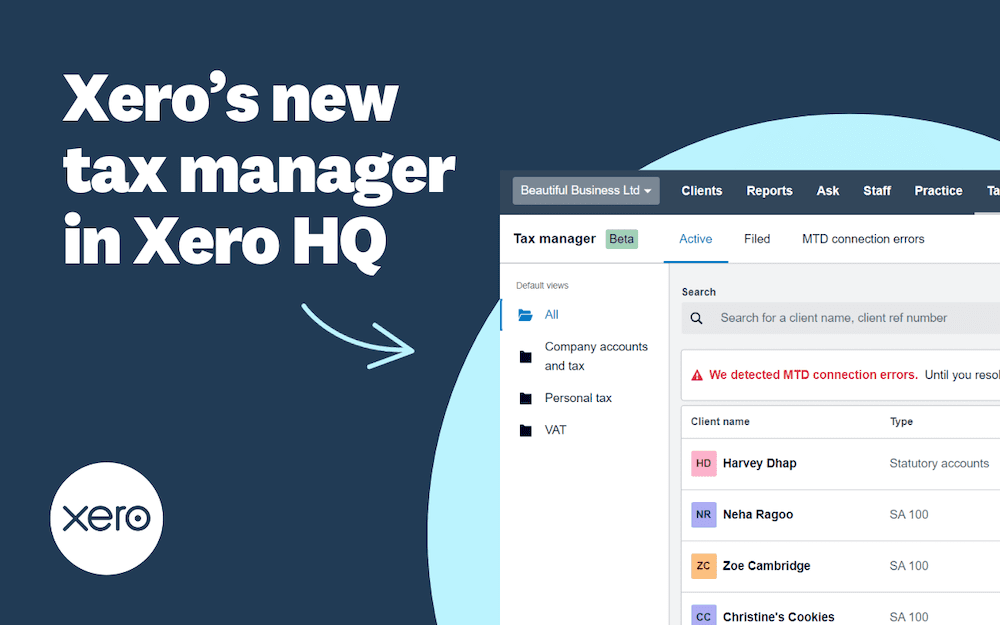

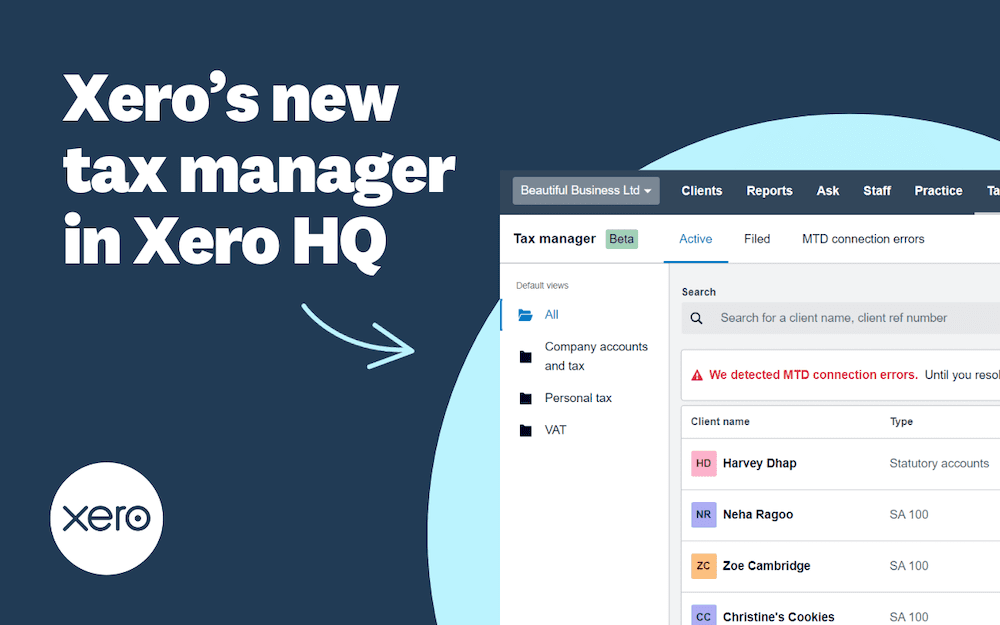

We’re excited to announce that we’ve launched a new tax manager feature in Xero HQ that will give you a real-time view of your tax obligations for company tax, company accounts, personal tax and VAT — all in one place.

This means that as an accountant or bookkeeper in the UK, you won’t have to use three different dashboards to get the information you need. It will all be there in tax manager, helping you track your clients’ tax deadlines and filing statuses, and understand what to prioritise.

Tax manager has been a highly requested feature in the UK, and brings us one step closer to having one set of connected practice tools — so you can work more efficiently, collaborate with clients more effectively, and manage everything for your practice within Xero.

A single dashboard for your clients’ tax obligations

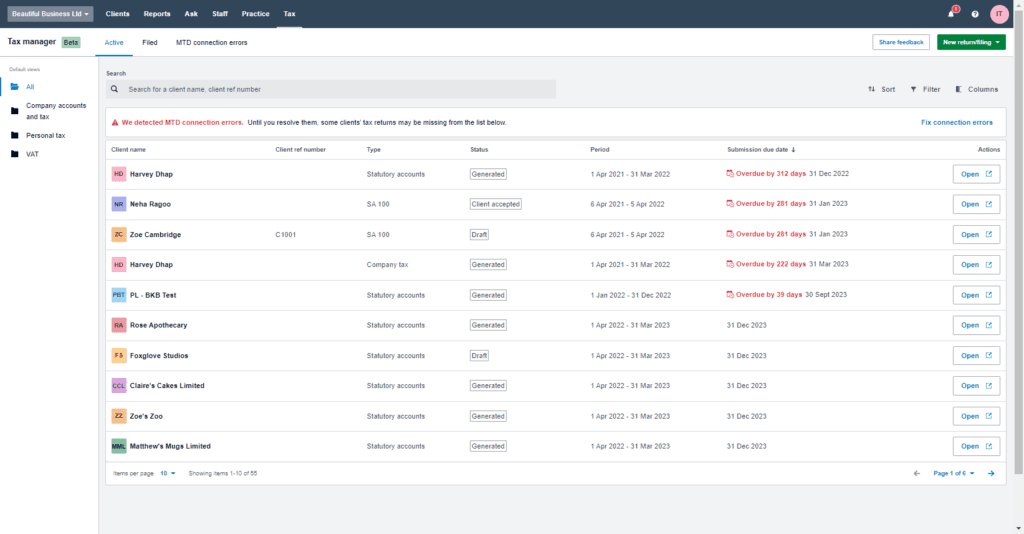

Tax manager is now available to all Xero Tax or VAT users in the UK. You can access it by visiting Xero HQ. In the ‘Tax’ menu, select ‘Tax manager’. This will take you to your dashboard, where you’ll be able to:

- see your active clients and manage upcoming due dates across all tax types

- view the ‘Filed’ tab for all completed obligations for your clients

- sort by submission due date, client name, client reference number, type, and status

- filter by a specific period, or use the search tool to find a certain client

- access an existing return or start a new filing directly from tax manager

- review VAT MTD connection errors

What’s next for tax manager in Xero

We have big plans for tax manager, and this is just the beginning. In the future, we’d like to add other compliance obligations to tax manager.

We also plan to integrate tax manager into XPM — our solution for managing client jobs, practice workflows, time tracking and invoicing. This will connect your client’s jobs to their tax obligations, making it easier for you to manage work across your practice.

We’re working closely with UK partners to make sure this integration provides the functionality you need in your practice. If you’d like to be part of the early access programme and provide feedback to our product teams, you can request early access to tax manager in XPM.

A single source of truth for your client records

Another way we’re connecting our practice tools is by creating a single client record across all of our practice tools. This central database gives you confidence that your client records are accurate and your team is working from the same information — no matter what practice tool they’re using.

The single client record is now available to all UK practices. If you’re using both Xero HQ and XPM, we’ve shared instructions to help you consolidate your records through a two-step process. This will reduce the need to switch tools, and remove duplication and double handling of data.

Ready to get started with tax manager?

If your practice doesn’t currently use Xero Tax or you want to get more out of our practice tools, we’re running a series of Xero Tax webinars where you can learn more. We’ve also created a self-paced course to help you set up XPM and use it to drive efficiency across your practice.

We can’t wait to hear what you think about tax manager in Xero HQ and will keep you updated as we continue to add more functionality — like more tax types and obligations — to the dashboard over time.