Do you want to make $100k a year in passive income?

This is an awesome goal, and it’s more achievable than you probably think.

While it’s going to take some work to get there, it’s totally possible by creating a plan.

In this post, I’ll explore how you can make $100,000 a year in passive income, some of the best passive income ideas, and much more. Let’s get started!

KEY TAKEAWAYS:

How to Make $100k a Year in Passive Income

1. Invest in Real Estate with Arrived

Investing in real estate is one of my favorite ways to earn passive income, and platforms like Arrived make it easier than ever.

This crowdfunding platform can be an excellent investment to generate monthly income and turn your money into more money.

Best of all, anyone can get started because the minimum investment is only $100.

It works by allowing you to pool your money with other investors and invest in rental properties across the country.

I am a huge fan of the ability to pick and choose which properties you invest in, so you know exactly what you’re investing in rather than a large pool of investments.

The company will handle all the legwork, and you can sit back and collect your earnings every quarter.

While it will take a decent amount of cash if you want to make $100k a year in passive income from your investment alone, this is a great place to get started and over time your balance will grow exponentially thanks to this compound interest investment.

2. Invest in Index Funds

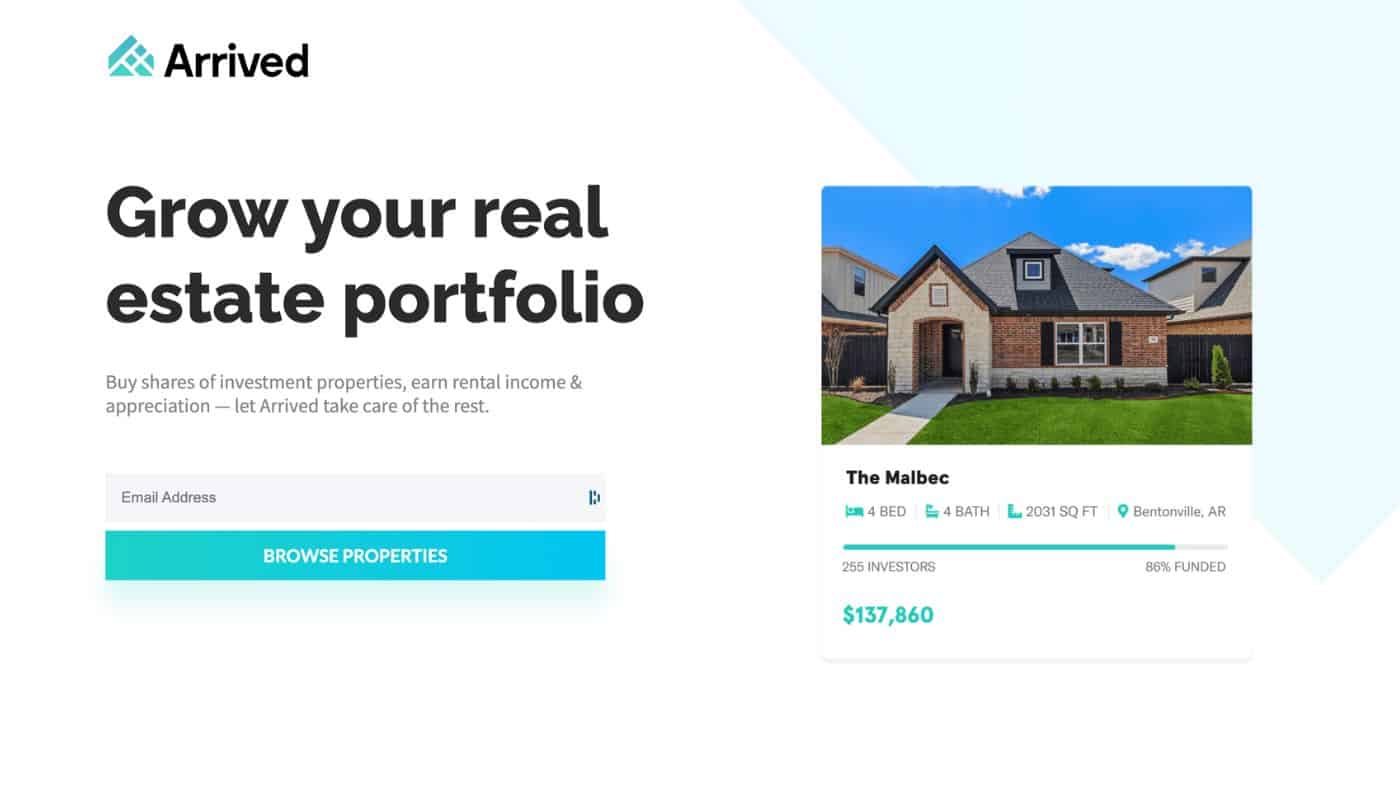

Another great method to start making money on autopilot is by investing in the stock market through index funds.

With index funds, you’re essentially investing in an entire sector of the stock market at once – which means you have a very diversified portfolio that will continue to grow over time.

Take a look at the returns of the S&P 500 over time. It’s hard to argue against those returns!

By using a platform like Acorns, you can start investing with as little as $5 and you’ll get $10 free when you open a new account.

Just like real estate investing, you can make a lot of money if you’re patient and invest for the long term.

To get started, simply sign up for Acorns and start investing today.

You can also consider investing in dividend stocks, which are stocks that pay you a portion of their profits each quarter.

3. Purchase Rental Properties

Owning your own rental property is another great way to generate a passive income stream and reach your financial goals.

Rental properties can be attractive for a few reasons.

Not only will you earn rental income from tenants, but you can also benefit from appreciation if the value of your property increases over time.

If you have a mortgage for your property, each payment you make will also help you build equity in the home – which can really add up.

Additionally, there are several tax benefits associated with rental properties that can help you save money come tax season.

While this method will require more money upfront to get started, it’s also one of the more profitable investments you can make.

You’ll typically need at least a 20% down payment when purchasing an investment property, but this will vary depending on the lender. There are also some other creative methods to finance your property like seller financing or even turning your existing home into a rental.

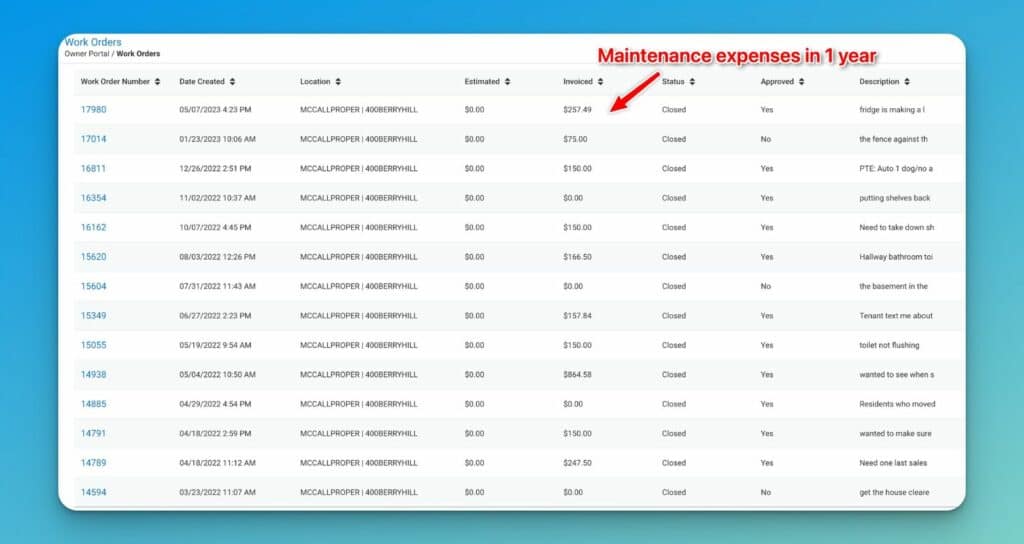

One downside to owning a rental property is the work that comes with it.

Between collecting rent payments, dealing with maintenance issues, and finding new tenants – it can be a lot of work.

Here’s the first year of expenses for my own rental property. You can see that it isn’t always cheap!

If you don’t have the time to do the work, you can consider hiring a property management company, but this can eat into your profits.

If you’re willing to put in the time and effort, though, rental properties can be a great addition to your investment portfolio and you can earn $100k a year with enough properties.

4. Invest in Small Businesses

If you’re searching for an investment with larger returns, investing in start-up small businesses with a platform like Mainvest can be a tremendous option.

With Mainvest, you can start investing in small businesses with as little as $100 and you have the potential to earn over a 25% return on your investment in some cases.

They work by connecting you with small businesses in your local community that are looking for funding.

Mainvest does all the work in vetting the businesses, so you can feel confident that your money is going to a good place but you should always complete your own due dilligence.

This is a great option for those who want to support a small business and local entrepreneur while also earning a great return on their investment.

To get started, simply sign up for Mainvest and start investing in small businesses today. New investors will also get $10 completely free!

5. Start a Blog

If you don’t have a large amount of money to invest but you want to make $100k in annual passive income, starting a blog is one of my favorite methods.

While it certainly won’t be passive at first, over time, it can become more and more passive.

The great thing about blogging is that you can start with very little money and there’s no limit to how much you can earn.

You can also start a blog in addition to a full time job to make extra money on the side.

It can take some time to grow your traffic and start earning a decent income from your blog, but over time is can be one of the best income sources you can start.

So, how do blogs make money?

There are many different ways you can monetize your site, but some of the most popular ways include display advertising, affiliate marketing, selling digital products or online courses.

If you’re looking for a passive side hustle – blogging can be a great option.

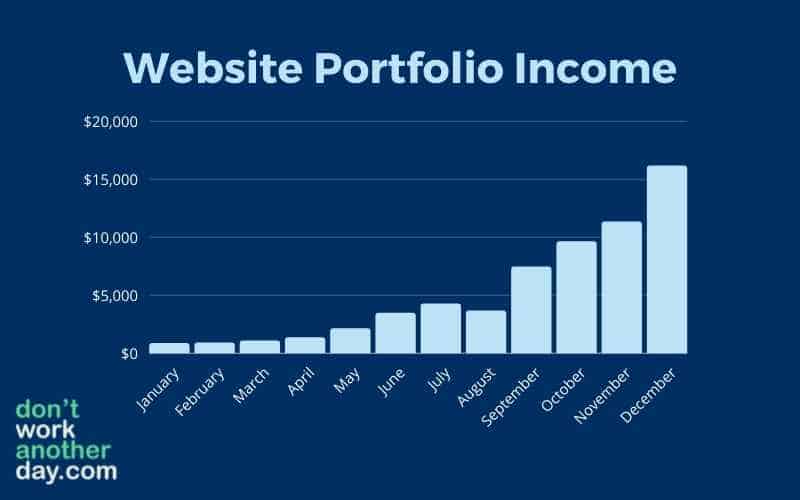

Check out my blog earnings in 2021! I’m making over $10k a month from this side gig and I’m sure you can do the same.

6. Start a Passive Business

While most businesses will be more active income than passive – there are some passive business ideas that can make you $100k a year (or more).

For example, a vending machine business can be a 90% passive business. The only work you’ll need to do is stock your machines and ensure they’re in working order.

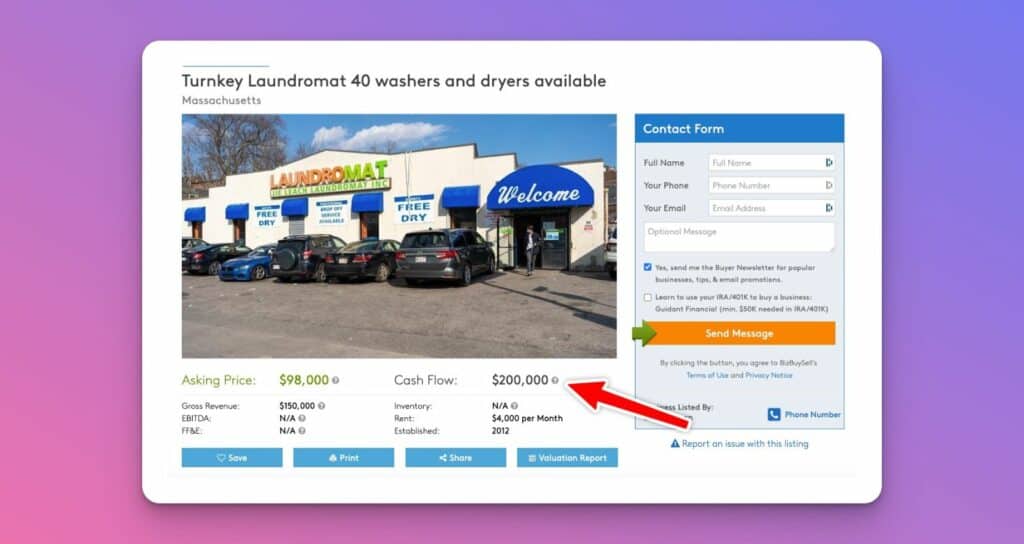

Another option is a laundromat business. Similarly, you’ll just need to make sure your machines are working and you can collect your earnings whenever you have some time.

Finally, you can start a service business and hire employees to do the work for you, making it a passive income stream.

Don’t want to deal with the hassle of starting and growing a business? You can always purchase an existing one!

For example, take a look at this laundromat for sale I found. It earns around $200k a year before expenses.

There are plenty of profitable business ideas and some cash flow businesses that you can start with very little money.

When it comes to starting a business, there are endless possibilities – so choose something you’re passionate about and get started today.

So, if you’re looking to earn $100k a year in passive income – starting a business is one of the best ways to do it.

7. Open a High Yield Savings Account

If you have money sitting in a traditional bank account earning a minuscule amount of money, switching to a high yield savings account can be an easy way to earn more passive income without any effort.

My favorite account is through CIT Bank. You can earn up to 10 times the national average on your money, with no monthly fees. While rates change depending on current market conditions, you can currently earn almost 5% on your money.

To put that in perspective, a $10,000 balance would earn you $200 in one year – just by switching to a high yield savings account.

Not too shabby for doing nothing! Open your free account below to get started!

8. Sell Online Courses or Digital Products

Want to make passive income online? Selling online courses and digital products can be a tremendous option to make $100k a year passively.

By selling these online assets, you can make great money without having to do much ongoing work.

I know some online course creators who make 7 figures each year in course sales without spending a penny on marketing costs!

Here’s exactly how to build and sell online courses!

9. Use Cash Back Credit Cards

Looking for free passive income?

Using cash back credit cards is a no brainer way to make money doing nothing.

Every time you make a purchase, you’ll earn money back – it’s as simple as that!

There are tons of great credit cards available that offer lucrative cash-back rewards and many of them will offer free money in the form of a welcome bonus when you complete a certain amount of spending in the first few months.

Just make sure you’re paying off your balance in full every month to avoid interest charges, which will negate any rewards you’ve earned.

Other Considerations On Your Journey to Financial Independence

Before investing your money, there are a few circumstances you’ll want to consider.

First, becoming debt free can be one of the smartest money moves you make. Not only will it save you money on interest, but it will free up more money to invest and save.

Second, you’ll want to make sure you have an emergency fund in place. This will help you cover unexpected expenses and keep your financial life on track if something unexpected comes up.

Finally, creating multiple income streams that generate cash flow is key to financial independence. Diversifying your sources of income will help protect you if one stream dries up and also ensure you have money coming in even if you’re not actively working.

Download My FREE Income Ideas Cheat Sheet!

Make. More. Money. Join 20,000+ subscribers learning how to boost their income and take control of their finances.

Don’t worry – we hate spam too. Unsubscribe at any time.

How Much Money Do I Need to Invest to Make $100k a Year in Passive Income

If you want to earn $100k in passive income each year from investing – you’re going to need some cash upfront.

To give you an idea, if you wanted to make $100k in passive income from rental properties, you’d need to purchase at least 4 properties (assuming each property generates $25k in annual income).

In order to determine exactly how much you’ll need, you’ll need to have an approximate return.

For example, the average return of the stock market is around 7% annually.

In this scenario, you would need to invest $700,000 to earn $100k in passive income.

Real estate investments can often have returns averaging around7% to 10% annually. This means you might need slightly less to reach your goal.

Final Thoughts on Making Passive Income

If you want to make $10k a month in passive income, there are plenty of options.

While some methods will require a significant amount of money to reach your goal, others can require much less.

Between investing in dividend stocks, affiliate marketing, selling digital products, and investing in real estate with Arrived – it’s easier than ever to make passive income and grow your net worth.

Download My FREE Income Ideas Cheat Sheet!

Make. More. Money. Join 20,000+ subscribers learning how to boost their income and take control of their finances.

Don’t worry – we hate spam too. Unsubscribe at any time.