13,992,339 Indirect Tax Filers and 13,82,013 Income Tax Filers in FY 2022-23

The Minister of State SHRI PANKAJ CHAUDHARY in the Ministry of Finance in a written reply to a question raised in Rajya Sabha, “13,992,339 Indirect Tax Filers and 13,82,013 Income Tax Filers in FY 2022-23”.

SHRI PARIMAL NATHWANI asked these questions in Rajya Sabha:

Will the Minister of FINANCE be pleased to state

(a) the numbers of Direct Tax payers vis-à-vis total Direct Tax collection in last five years;

(b) the numbers of Indirect Tax payers vis-a vis total Indirect Tax collected in last five years; and

(c) the details of steps taken by Government to increase the number of tax payers and the collections?

The Minister of State replied:

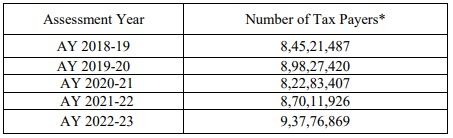

(a) The number of direct tax payers, assessment year wise, are as under:

The information relating to total Direct Tax collection from Financial Year 2018-19 to 2022-23 is as under:

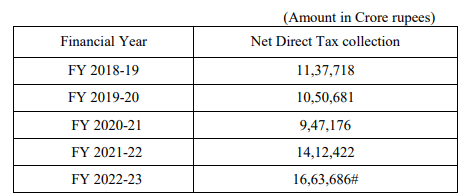

(b) Total number of tax payers and total Net Central Indirect taxes collection for last five years are as under:

(c) The actions taken by the government to increase the number of tax payers and the collections include:

Direct Taxes:

(i) Phasing out of exemptions and deductions and simplification/rationalisation of tax laws.

(ii) Reducing litigation and widening of tax base by promoting voluntary compliance which includes New Form 26AS, Pre-filling of Income-tax Returns, E-Verification Scheme, providing facility to the taxpayer for Updated Return, and expansion of TDS/TCS by bringing new transactions into its ambit, etc.

(iii) Steps taken to promote digital transactions to create less cash economy such as TDS on cash withdrawal above a threshold.

(iv) to generate awareness about the instalments of advance tax, timely payment of self-assessment tax and regular assessment tax, etc.

(v) Other steps such as, making the payment of tax easier through online mode like RTGS, NEFT, Debt/credit card or Net Banking.

(vi) Launch of mobile app (available on Android/IOS platform) and responsive version of the Tax Payer Services (TPS) section at the national website called “Aaykar Setu” to facilitate online payment/calculation of the taxes.

Indirect Taxes

(i) Simplification of GST processes to facilitate trade and thereby, easing tax compliance in GST to encourage more businesses to register voluntarily including business that are under threshold exemption.

(ii) Establishment of Centre-State Coordination Committee in all the CBIC Zones/States to conduct awareness and outreach campaigns to educate businesses and consumers about the benefits and requirements of registration under GST so as to increase tax base.

(iii) On the compliance front, usage of data analytic tools, third party data from other sources and artificial intelligence to identify tax evaders to take targeted enforcement action to enhance GST collection.

(iv) Mandating e-way bill, ITC matching, mandating e-invoice, development of artificial intelligence and machine-based analytics, integration of e-way bill with fast tag etc.

(v) Faceless, contactless and paperless processing of customs clearance, risk based facilitation and targeted intervention including non- intrusive inspection for increased tax compliance and custom duty collection.

Join StudyCafe Membership. For More details about Membership Click Join Membership Button

In case of any Doubt regarding Membership you can mail us at [email protected]