If you received a bonus you’re likely curious about taxes. You might be asking, “how taxes are withheld from your bonuses when you receive them?”

Receiving a holiday bonus is exciting, but it can be confusing to calculate your bonus tax. Learning how your bonus is taxed can help you determine how much money you’ll receive after taxes.The IRS views any bonus you receive as wages. This means that almost all bonuses are taxed. In this guide, we’ll discuss tips for receiving bonuses and explain how you can use our bonus tax calculator to determine how much taxes will be withheld when you receive it.

Are taxes withheld when you receive a bonus?

At the time of receipt of your bonus, federal taxes are typically withheld by your employer that can be at ahigher tax rate than your actual tax rate used when you file your taxes.

But don’t worry, since your actual tax rate based on your total taxable income for the year could be lower, you may get back some of what was withheld from your bonus as part of your federal tax refund.

How are bonus taxes calculated?

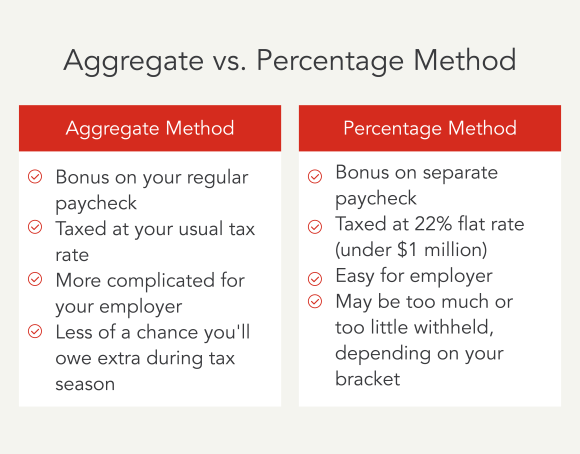

Employers typically use either of two methods for calculating federal tax withholding on your bonus:

- The aggregate method

- The percentage method

Aggregate method

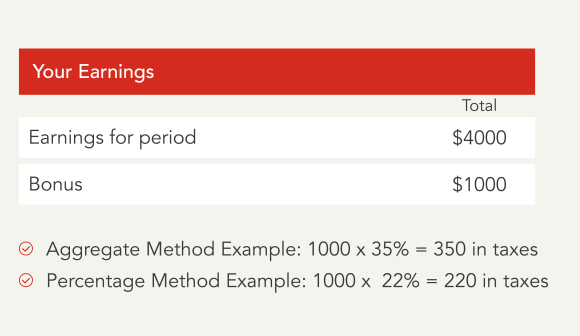

If you receive your bonus along with your paycheck your employer will use the aggregate method to calculate your withholding.

With the aggregate method, your employer or payroll provider will withhold federal taxes at the same percentage that’s normally withheld from your paycheck.

If 35% is withheld when you are paid, then your employer will withhold 35% from your bonus when you are paid your bonus.

Percentage method

When your employer issues your bonus separate from your paycheck your employer or payroll provider will withhold taxes using the percentage method.

The percentage method is the simplest way to withhold bonus taxes since your employer or payroll provider will withhold federal taxes at a flat 22% rate and not at your normal tax rate when you are paid.

Generally, most employers and payroll providers choose to use the percentage method. Under tax reform, the federal tax rate for withholding on a bonus was lowered to 22%, down from the federal income tax rate of 25%.

Check out our updated bonus calculator. This tool answers one of our most frequently asked questions. You’ll get an estimate of how much federal taxes you can expect to be withheld from your bonuses when you receive them.

What are the pros of each bonus tax method?

The pros of each method depend on what your regular tax rate is. If you are in a lower tax bracket with a lower tax rate, then being taxed at your regular lower tax rate in the aggregate method as opposed to the percentage method at 22% is probably more beneficial to you. If you are in a higher income bracket and your tax rate is over 22% then having taxes withheld using the percentage method will give you more of your bonus. One thing to remember, at tax time you may get some of what was withheld from your bonus back when you file your taxes.

What are the cons of each bonus tax method?

There are downsides to both the aggregate and percentage methods.

The aggregate method can add unnecessary confusion to your bonus taxes because your income tax rate comes into play, which involves your W-4 form. In some cases it can lead to paying a larger percentage of your bonus in taxes which also means you have access to a smaller portion of your bonus.

If your regular tax rate is higher than the flat 22% rate used in the percentage method, then the percentage method provides you with more of your bonus than the aggregate method. However, this could result in a smaller tax refund or possible taxes owed.

At the end of the day, the method used by your employer or payroll provider depends on if you receive your bonus together with your paycheck or separately. For a contractor bonus, taxes are not withheld since you are considered self-employed so it’s best to use tax saving tips for contractors included here.

Are there any bonuses that might not be taxable?

Bonuses you receive from your employer are considered supplemental income. This means they’re taxable by the IRS. However, certain fringe benefits may not be considered taxable bonuses. This includes benefits like event tickets and gift baskets.

Other gifts received as awards may also be exempt from taxes in some cases. This might include:

- Cash

- Cash equivalents

- Vacations

Are bonuses taxed federally and by the state?

Bonuses are always federally taxed, and some states may have additional taxes for bonuses. Bonus tax rates vary from state to state, so you can check your state tax regulations to determine your tax rate.

Are there ways to minimize bonus taxes?

There are several ways you can minimize the amount of bonus taxes you owe, but it’s important to abide by federal and state tax laws. Here are some tips for minimizing bonus taxes:

- Ask your employer to defer your bonus until next year

What happens if too many taxes are withheld from your bonus?

If too much taxes are withheld from your bonus, you may get some of what was withheld back in the form of a tax refund once you file your taxes.

Lower the bonus taxes you owe and maximize your refund

Tax season can bring about new tax implcations, especially if you recently received your first bonus. Our bonus-tax calculator makes it easy to estimate how much taxes will be withheld from your bonus when you receive it. That way, you can get an estimation of how much of your bonus you will keep and figure out what moves you can make to help your finance and tax outcome.

Try our bonus calculator for an estimate of your bonus tax withholding. No matter what moves you made last year, TurboTax will make them count on your taxes. Whether you want to do your taxes yourself or have a TurboTax expert file for you, we’ll make sure you get every dollar you deserve and your biggest possible refund – guaranteed.