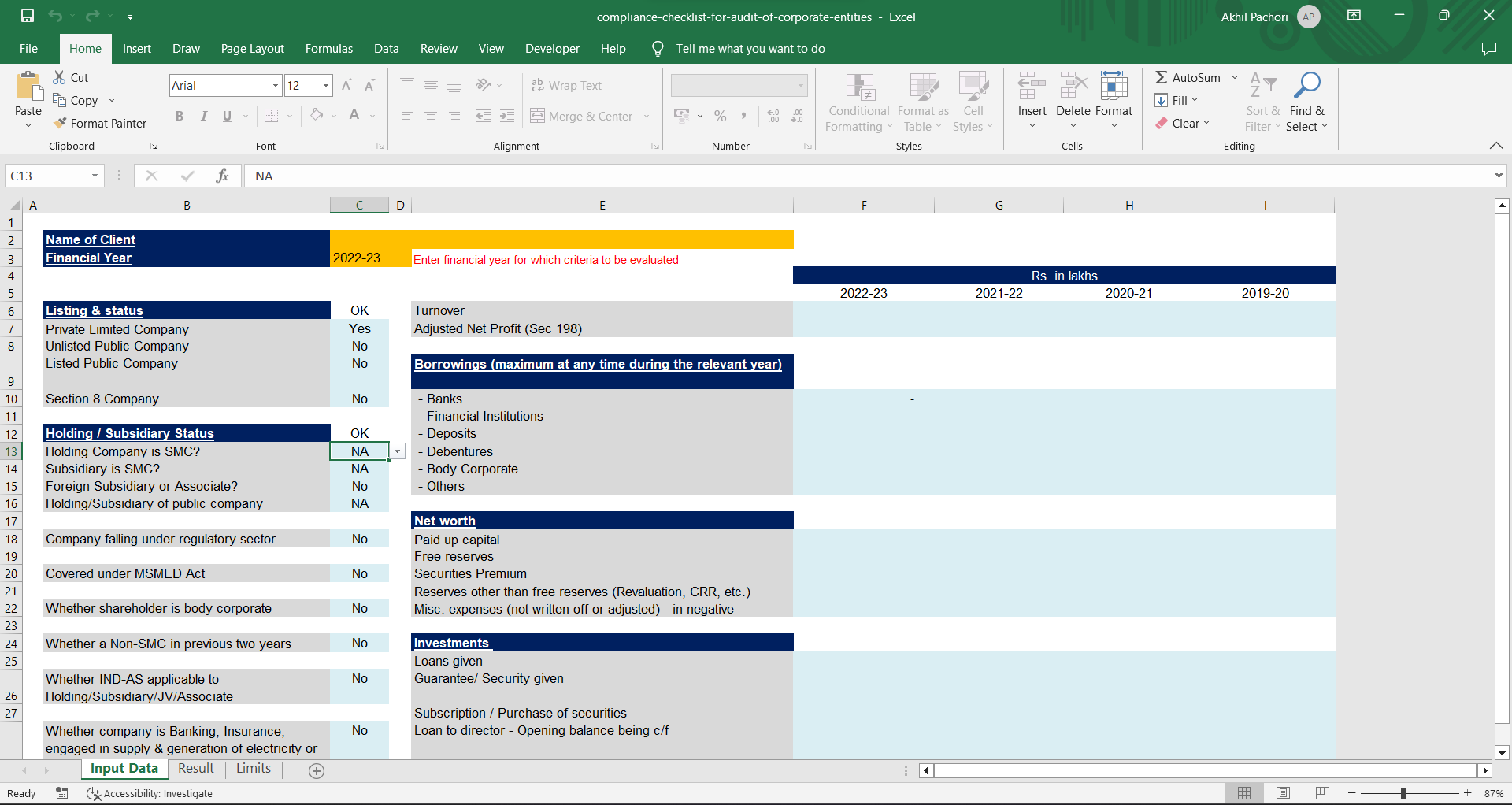

Excel Sheet for Compliance checklist for audit of Company Entities

The Audit season is around the corner in India. Big Companies or the companies who comes under the ambit of audit criteria needs to done their audit. Auditing provides assurances to the company’s owners, investors, and shareholders regarding the accuracy of its books of accounts. A regular audit is needed to show the business’s credibility to all stakeholders, including clients, owners, creditors, and employees. The smooth operation of the company opens the door to new and exciting business options.

Conducting an audit helps the organisation to take corrective measures that will be advantageous in the long run. Important considerations such as the existing business’s position, profit margin expectations, and profit maximisation can be addressed. Furthermore, the auditor can counsel the corporation on long-term tax planning and the decrease of unethical actions.

Internal audit, Statutory audit, external audit, financial audit, forensic audit, tax audit, and information system audit are all types of audits that may be performed based on the size and needs of the organisation.

Here is the Compliance checklist for audit of Company Entities.

A compliance audit checklist is a tool used by external or internal auditors to analyse and verify an organization’s conformance to government legislation, industry standards, or its own policies.

Click Here to Download the Copy

Join StudyCafe Membership. For More details about Membership Click Join Membership Button

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe’s WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!”