Income Tax Rules for New Financial Year 2024-25

Many Income tax rules often take effect on April 1st, the start of the new financial year. Even if income tax rules are introduced in the Union Budget or in the midst of a financial year, they typically go into effect when the next financial year begins.

During this year’s interim budget, the government declared no changes to income tax laws for the financial year 2024-25. As a result, the prior financial year’s income tax laws remain in effect.

Here is a list of the income tax rules that will stay in effect beginning April 1, 2024:

Choose between the Old and New Tax Systems

For TDS (tax deducted at source) on salary, the employee must choose between the old and new tax regimes. Remember, the new tax regime is the default option. If you do not advise your employer that you want to continue with the previous tax regime, your employer will deduct tax from your pay income in accordance with the new tax regime. Do it as soon as your employer asks you.

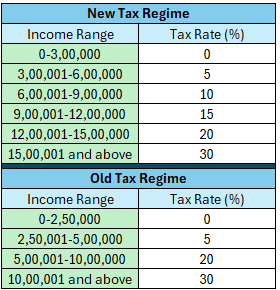

Old and New Tax Regime Basic Exemption Limit

There is a difference in the fundamental exemption limit between the old and new tax systems. If an individual’s income does not exceed the basic exemption limit in a financial year, that individual’s income is tax-exempt. Currently, under the new tax regime, income up to Rs.3 lakh is tax free. This exemption limit applies to all individuals opting for the new tax regime, regardless of age. In the old tax regime, an individual’s basic exemption limit was determined by his or her age.

Individuals under the age of 60 are excused from paying taxes on earnings of up to Rs.2.5 lakh in each financial year. For senior adults aged 60 to 80, Rs.3 lakh is tax-free in a given financial year. Income of up to Rs.5 lakh is tax-free for super senior citizens aged 80 and higher.

Available Tax Deduction and Tax Exemption

Both tax regimes include some deductions and exemptions. However, the old tax regime provides more tax exemptions and deductions than the new tax regime. Section 80C allows for deductions of up to Rs.1.5 lakh for specific investments and expenses, Section 80D for health insurance premiums, and Section 80CCD (1B) for additional deposits in the National Pension System (NPS) of up to Rs.50,000.

Individuals can also claim a deduction for interest paid on housing loans up to Rs.2 lakh, interest paid on education loans, and deductions for donations to charities.

Aside from deductions, individuals can claim a tax exemption on house rent allowance (HRA) and leave travel allowance (LTA).

Individuals can only claim two deductions under the new tax regime. These include the standard deduction of Rs.50,000 from salary and pension income, as well as the Section 80CCD (2) deduction for employer contributions to the NPS account. Family pensioners are also eligible for a standard deduction of Rs.15,000 under the new tax regime. These deductions were available under the old tax regime as well.

Individuals can reduce their net taxable income and tax liabilities by claiming allowable deductions (depending on the tax system they choose).

Zero Tax payable under Old and New Tax Regime

Income tax laws provide tax benefits to residents under both tax regimes. The tax rebate, provided under Section 87A, results in zero tax payable if net taxable income does not exceed the stated maximum. The new tax regime provides a larger tax rebate than the previous tax regime.

The new tax regime provides a tax rebate of up to Rs.25,000, resulting in 0% tax owed on incomes up to Rs.7 lakh. The old tax regime provided a tax rebate of up to Rs.12,500, resulting in 0% tax owed on net taxable income of up to Rs.5 lakh.

Reduced Surcharge in New Tax Regime

A high-income earner who opts for the new tax regime will pay a reduced surcharge rate. Under the new tax regime, the rate has been decreased from 37% to 25% on incomes above Rs.5 crore. However, if the individual chooses the old tax regime, a 37% surcharge will apply.

File ITR on time to obtain the Old Tax Regime Benefit

If you intend to file your income tax return under the old tax regime this year, make sure to do so before the July 31 deadline. This is because the new tax regime is the default choice, and income tax laws allow an individual to switch to the old tax regime only if the ITR is filed on time. If an individual files a belated ITR (between August 1 and December 31), his or her tax burden will be computed exclusively under the new tax regime.

Join StudyCafe Membership. For More details about Membership Click Join Membership Button

In case of any Doubt regarding Membership you can mail us at [email protected]