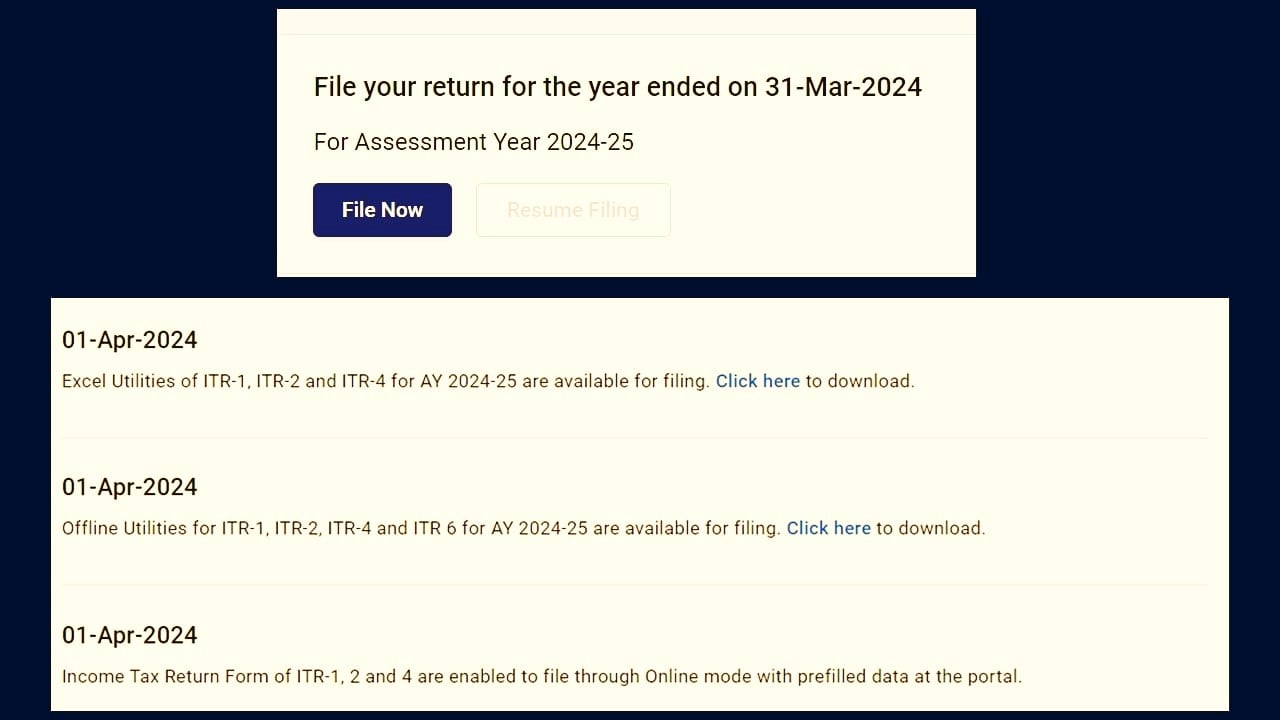

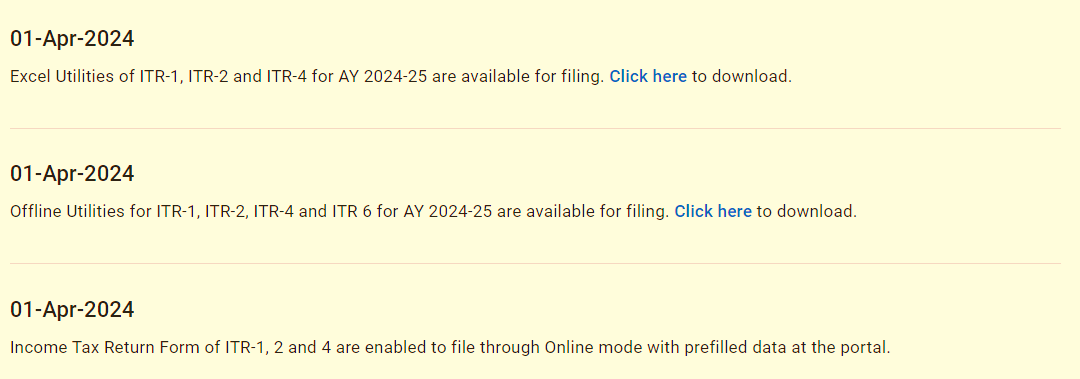

ITR Filing Utilities for ITR-1, ITR-2, ITR-4 and ITR-6 for AY 24-25 released by Income Tax Department

The Income Tax Department presented an amazing gift to taxpayers at the start of the financial year 2024-25. On the Income Tax Portal, the Utilities for Filing ITR-1 (Sahaj), ITR-2, ITR-4 (Sugam), and ITR-6 for Assessment Year 2024-25 are now available.

ITR-1, ITR-2, and ITR-4 for the financial year 2024-25 are accessible in Offline, Excel, and Online modes for filing the return. Only ITR-6 is available in offline mode.

The option to opt out of the new tax regime by completing Form 10-IEA in accordance with Section 115BAC and Income Tax Rule 21AGA is also accessible.

Yes, the utility to file the Income Tax Return is now available. But, wait! Can you submit your ITR now? For the most part, the answer is no. The reason for the same is:

SFT Not filed: Statement of Financial Transactions (SFT) for the financial year 2023-24 will be filed till May 31, 2024. The Annual Information Statement (AIS) will be entirely updated after the SFT has been filed.

No updation of Form 26AS: Most individuals are required to claim TDS or TCS on their income tax returns. The due date for filing TDS returns for the fourth quarter of the financial year 2023-24 is now May 31, 2024, and the due date for Quarter 4 TCS returns is May 15, 2024. This means that in most circumstances, the entire TDS will not be recorded before the first week of May, while TCS will only be reflected after May 15th.

ITR Filing Due Date

Though the due date to file ITR for FY 2023-24 for Non-Tax Audit cases is July 31st, and main ITR utilities are now available, in the bulk of cases, ITR can only be filed after May, giving taxpayers approximately two months to complete their ITR without incurring late fees.

ITR Filing Late Fees After Due Date

The late filing fee for filing an Income Tax Return (ITR) after the due date is Rs.5,000 if your income exceeds Rs.500,000 and Rs.1,000 otherwise. Also, the belated ITR for FY 2023-24 can be filed till December 31, 2024.

Taxpayers who have no TDS, TCS, or AIS in their ITR are free to file their Income Tax Returns.

Join StudyCafe Membership. For More details about Membership Click Join Membership Button

In case of any Doubt regarding Membership you can mail us at [email protected]