UPI operations were started in 2016 in India. It was expected to add UPI payment option with the launch of new Income Tax Portal in last year on 07th June 2021.

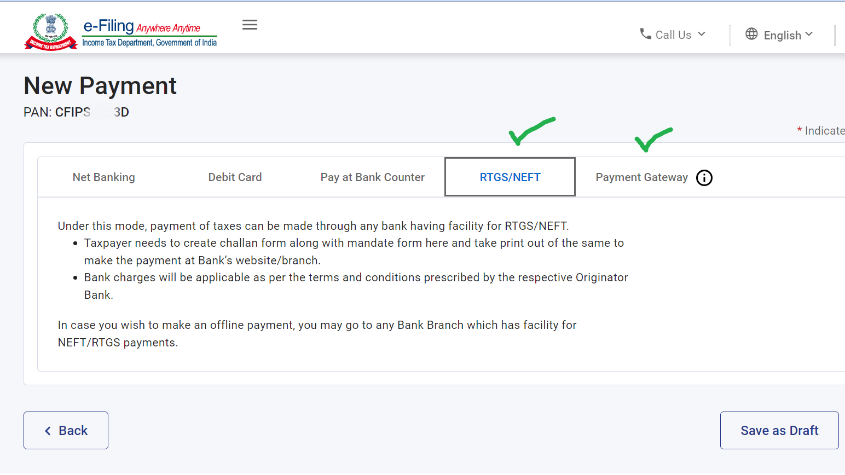

Now, the income tax e-filing website enables the E-pay tax service with increased number of payment option adding RTGS/NEFT and Payment Gateway. Under payment Gateway, wide range of options to the taxpayer are available including Net Banking, Debit Card, Credit Card and UPI. However transaction charges will be applicable under this method, the details of which is as follows:

{Pro Tip: Income Tax Return Filing}