Prefilled ITR Expanded to include Brought Forward Losses and MAT Credit

The Income Tax Department‘s facility for the taxpayer to get data pre-filled in their income tax return filing process is corporating in making tax compliance easier.

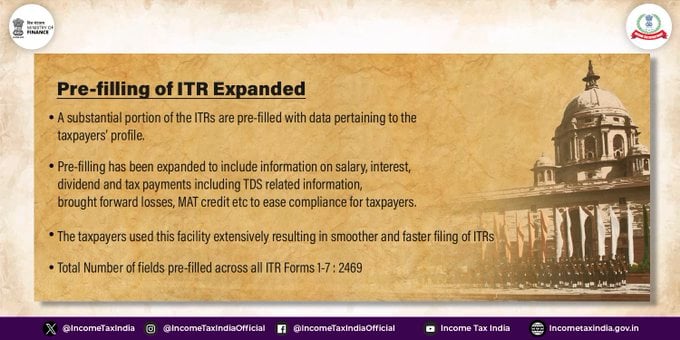

IT Department shared this news on its official Twitter account, it wrote, “Income Tax Department @IncomeTaxIndia boosts Ease of Compliance with smoother and faster filing of ITRs. ITRs with pre-filled data expanded to include salary, interest, dividend, TDS-related information, brought forward losses, MAT credit, etc.”

Growing the amount of pre-filled data in ITRs was one way the Income Tax Department was trying to make compliance easier. Salary, interest, dividends, information on Tax Deducted at Source (TDS), carried forward losses, and Minimum Alternate Tax (MAT) credit are among the details about taxpayer profiles that are now pre-filled into a significant percentage of ITRs.

The expansion made it possible to file ITRs more quickly and easily by adding 2,469 new fields to all ITR Forms 1-7.

Join StudyCafe Membership. For More details about Membership Click Join Membership Button

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe’s WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!”