ITR Filing: How to decide which Regime to choose

The Income Tax Department‘s recent release of the ITR-1, ITR-2, and ITR-4 forms for FY 2023-24 (AY 2024-25) marks the start of the tax filing season. As is traditional, the IT department has set a July 31 deadline for submitting Income Tax Returns (ITRs). However, discussions over taxation began earlier this year as a result of the implementation of the new tax regime as the default choice if not previously chosen.

Taxpayers must make a critical decision between the old and new tax regimes. The recent events have left taxpayers in a state of anxiety and confusion as they consider the consequences of each regime for their financial commitments.

Despite this complexity, it has extensively compared old and new tax regimes, including crucial factors such as tax slabs, and the implications for taxpayers are assessed, providing clarity in navigating this critical decision. Here are some tips from tax experts to help you choose a proper tax regime.

Chose Suitable Tax Regime (New Vs. Old)

Choosing a tax regime is always determined by your income bracket and the amount of your deductions. One should analyze the tax due after taking into account unavoidable expenses and unstoppable investments. Many taxpayers would be paying unavoidable expenses and unstoppable investments with tax benefits.

As stated by the tax expert, Tax planning, which covers unavoidable expenses and irreversible investments, is an important component of selecting a tax regime. Individuals can efficiently use tax-saving options to improve their financial situation.

Unavoidable Tax-Deductible Expenses

Unavoidable expenses are those that are incurred without the primary goal of saving money on taxes. These expenses, while necessary for daily living, also provide tax advantages, lowering your taxable income.

These unavoidable expenses are:

1. Accommodations Rent: Individuals who live in rented housing can claim House Rent Allowance (HRA) deductions under certain requirements stipulated by the Income Tax Department.

2. Principle Amount and Interest of Home Loan: Section 24(b) of the Income Tax Act allows for tax deductions on house loan interest, but Section 80C allows for deductions on principle repayment.

3. Tuition Fees of Children: Section 80C allows parents to deduct tuition payments for their children’s education, providing extra tax savings options.

Individuals can efficiently cut their taxable income and minimize their tax liability by taking advantage of these unavoidable charges.

Maximizing Tax Benefits of Unstoppable Investment

Unstoppable investments are commitments made by individuals that require constant contributions to be maintained. While these investments involve regular financial commitments, they also provide large tax benefits.

1. Provident Fund Investment: Employee contributions to provident funds are eligible for tax deductions under Section 80C, resulting in long-term savings and tax benefits.

2. Life Insurance: Premiums paid for life insurance contracts are tax deductible under Section 80C, providing policyholders with financial protection as well as tax savings.

3. Sukanya Samriddhi Scheme: Investments under the Sukanya Samriddhi Scheme benefiting girls are eligible for tax deductions under Section 80C, fostering financial security and empowerment for future generations.

4. Premium of Medical Health Insurance: Premiums for medical health insurance policies are tax deductible under Section 80D, providing people and their families with complete healthcare coverage as well as tax benefits.

Before deciding on a tax regime, individuals should efficiently manage tax liabilities by fully comprehending both unstoppable expenditures and unavoidable investments. Individuals can make informed decisions about their financial situation by carefully estimating taxable income and taxes.

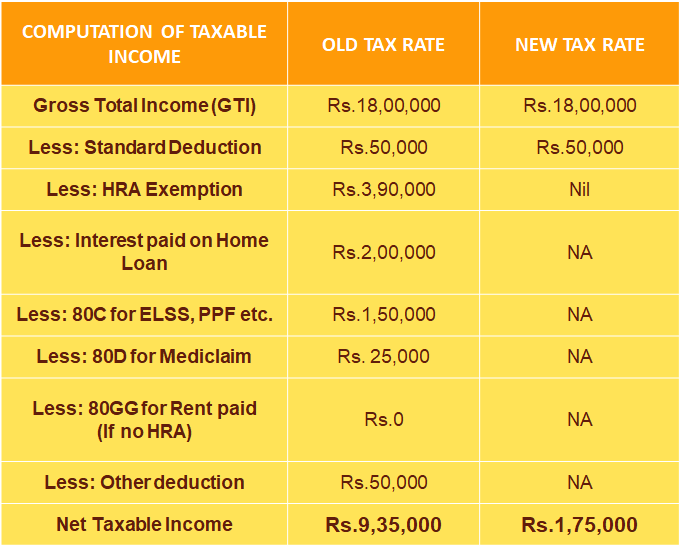

Let’s take an example where a taxpayer’s annual income is Rs.18 Lakhs:

Looking at these figures, the new regime appears more tempting. But what if you consider unavoidable expenses and essential investments that provide tax benefits? Under the old regime, an income of Rs. 9.35 lakhs would have resulted in a tax liability of Rs. 1,03,480. Under the new regime, a income of Rs. 17.5 lakhs would be Rs. 2,34,000. Choosing the old regime may cut your tax liability by Rs. 1,30,520.

After evaluating both regimes, if you choose the old regime, look for further ways to save by investing more. If you choose for the new regime, avoid investing in tax-saving funds. Remember to notify your employer of your decision, although you can also make modifications when you file your income tax return.

Join StudyCafe Membership. For More details about Membership Click Join Membership Button

In case of any Doubt regarding Membership you can mail us at [email protected]